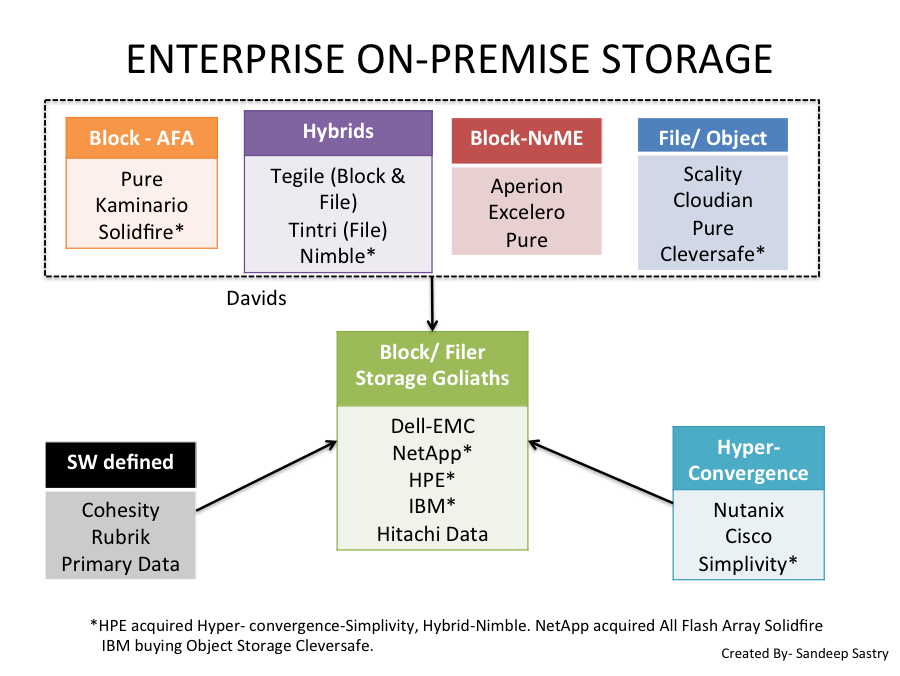

I have written a post on How does David Take On and Become Goliath? Let us consider the current Enterprise Data Storage Industry and analyze the Davids and Goliaths applying the following model.

The enterprise data storage industry primarily consists of Storage Area Networking (SAN) based Block storage, File based storage and Object based storage.

Over the last two decades, there were relatively lesser technological advancements in terms of performance as compared to the Server Computing and Networking industries.

It was a profitable business with few new entrants, who got crushed and acquired by the industry Goliaths. Currently the industry is going through three major transitions

- Traditional disk drives to hybrid Flash/disk to All Flash Arrays- The value proposition of All Flash Arrays is stellar performance, lesser rack storage space and energy costs as well as less than dollar/GB costs.

- Buying servers, storage and networking separately to buying converged systems– The value proposition is one or more industry players define a validated design that is pretested to interoperate reliably, easy administration with advanced management tools and simplified support.

- Hyper-Convergence – Combining the server, networking and storage in one box virtualized through server minimizing hardware costs.

EMC was the incumbent leader in this space until Dell bought them in 2016 forming a combined company Dell-EMC. Network Appliances (NetApp) is second major player along with IT industry veterans IBM, HPE and Hitachi Data Systems (HDS).

There are many Davids emerging in various categories such as All Flash, Software Defined, Hybrids and NvMe. Most of the Davids are growing quickly and yet to be profitable.

All Flash Array Pure and Hyper-Convergence Nutanix are post IPO independent Davids aiming to grow to a billion dollars of revenue in next couple of years.

Goliath Hewlett Packard Enterprise (HPE) acquired Hybrid Nimble and Hyper-convergence –Simplivity to beef up their offerings.

NetApp acquired the All Flash Solidfire to enhance its FAS offering. It will be interesting to see the evolution in the coming years.

How did EMC become the Goliath?

Startup- Create a product for an unmet need

Richard Egan and Roger Marino started EMC in 1979 selling circuit boards to increase pre-existing memory in mini-computers extending the lifecycle enabling customers to upgrade using existing equipment rather than buying a new computer.

It had more capacity, was more reliable and half of the price of the competitor.

Growth- Aggressive Sales

EMC grew the company in the initial years investing in sales rather than in engineering. Roger Marino, who in charge of sales developed an aggressive sales force hiring competitive sports athletes, who most recent graduates.

Marino said in a 2003 Boston Magazine interview,

“I hired guys I liked. I like smart people. I like athletes. These guys that worked for me were smart athletes, and they went out and killed”

Digital Equipment Corporation, a Goliath back then, sued EMC for infringement, which was later settled. EMC went IPO in 1986.

Maturity- Hiring Engineering Talent, launching new products, timing market transitions, exiting markets and growing by acquisitions

In 1988, EMC realized they needed to launch new products to sustain and hired Moshe Yanai, an Israeli Engineer to develop its first mainframe disk storage. EMC went loggerheads with IBM, the Goliath.

Moshe’s team launched Symmetrix high-end array that was the single most important product in EMC’s history and along with a great sales force catapulted the company to a standalone storage supplier.

Symmetrix is still in production today as the VMAX system. EMC reached revenues of $1.3B dollars in 1994 and displaced IBM as a market leader in the mainframe disk storage.

EMC was profitable that time with a net income of 250M.

In 1995, EMC saw the market transition of mainframes to client server systems such as Windows NT and Unix and introduced the market’s first platform-independent storage system for open systems.

Within two years, the Windows NT & Unix sales surpassed the mainframe disk storage sales. EMC acquired network switch vendor McData Corporation, positioning EMC for the emerging network storage market.

In 1996, EMC entered the file server market, calling it the Network-Attached Storage (NAS) market.

In 1999, EMC entered the storage area network (SAN) market, making it easier to connect multiple storage devices to multiple servers via Fibre Channel networking technology.

EMC continued to grow till the late 1990s with a steadfast focus on customer service and ended the 1990s as the second-best performing stock on the S&P 500—after Dell—and the number one stock of the decade by the New York Stock Exchange

EMC heralded the new millennium with change in leadership hiring Joe Tucci as CEO.

EMC made a number of strategic acquisitions to enhance its product feature sets such as virtualization, de-duplication and backups.

EMC took a good call to exit the profitable memory products in 1991 to focus on the mainframe disk storage at that time.

EMC also experienced dark patches during their growth story during late 1980s when their mainframe disk product failed due to quality issues causing losses and during 2001 downturn.

EMC share price hit a low of $3.62, down from $104 in September 2000. EMC bounced back and through various acquisitions grew their revenues to $25B in 2015.

Over the last five years, EMC had tepid revenue growth and declining profitability.

EMC agreed to be bought by Dell completing the transaction in Aug 2016.

To sum, companies need to continuously innovate either organically or inorganically, they can be successful for years and even decades but the time they stop, they are subject to takeovers.

REFERENCES

Symmetrix daddy Moshe Yanai on chair-throwing and storage

https://www.theregister.co.uk/2017/04/10/moshe_the_storage_mensch/

EMC Annual report 1997

https://www.emc.com/about/emc-at-glance/annual-overview/1997/annual-report-1997.pdf

EMC History

Difference between Converged and Hyper-convergence

https://www.youtube.com/watch?v=2IUX6swaOC4

Data Storage Competitors

https://www.theregister.co.uk/2016/12/13/old_storage_guard_flash/

EMC Acquisitions

Legato Software- Backup and Recovery

VMWare- Virtualization

Rainfinity- Network Attached Storage

RSA Security- Security

Avamar- Data Protection

DataDomain- Data Deduplication

GreenPlum- Big Data Analytics

Isilon- Network Attached Storage

XtremIO- All Flash Array

ScaleIO- Server Side Storage