In the world of Big Data Analytics and Alternative Facts, it is essential that we question metrics and look at any issue deeply and holistically.

I present a couple of popular beliefs, where the metrics when viewed individually can lead you to wrong inferences.

Popular Belief- Stock Repurchase (Buybacks) is beneficial to the company shareholders.

If you have listened to the quarterly conference calls over the last fifteen years of the many large Fortune 500 companies, CEOs have announced repurchasing their company stock spending billions of dollars giving the primary reason that the stock price is undervalued.

Wall Street analysts track the Earnings per Share (EPS) metric closely every quarter as it affects the stock price.

EPS = Net Income/ (Average Number of Outstanding shares of common stock)

So stock repurchases are essentially reducing the number of outstanding shares (mathematically decreasing the denominator) whereby increasing the EPS and in turn the stock price.

There is less circulation of stock in the market whereby increasing the demand for the stock. Research shows that the timing of these buybacks is often questionable as the stock price is overvalued.

Warren Buffet has said,

“In repurchase decisions, price is all-important. Value is destroyed when purchases are made above intrinsic value.”

So why do companies buy at high prices?

Many companies incentivize their leadership teams and their employees with stock based compensation, which involves issuing new stock when they are redeemed therefore increasing the number of outstanding shares.

Some of the companies fund their US based acquisitions by issuing stock, as they do not want to pay the 35% repatriated tax rate to access overseas cash.

Companies are also using debt to pay for the stock repurchase due to the low interest rates. So buybacks are balancing acts to keep the average number of outstanding shares of common stock in check.

Popular Belief – US Manufacturing has been declining since the 1960s

It might be surprising to know that US manufacturing output over the last fifty years has been fairly consistent between 12% and 14% of the total GDP in the price-adjusted inflation terms despite Globalization.

It is contradictory that the employment share of manufacturing jobs has seen a steady decline from a high of 25% to low of 8% in recent years.

This is because of the productivity efficiencies with technological automation making some of the jobs redundant.

If you do a deeper dive, there is change in the mix of the industry output as computer and electronics sectors have grown whereas other sectors have declined.

There is also a geographical impact across industries. The point to note is that when one of these metrics is viewed individually, it can paint a very different picture.

Manufacturing Value-Added and Employment as a Share of the Total U.S. Economy, 1960–2011 (in 2005 prices)

Source: Industry Accounts of the Bureau of Economic Analysis- US Manufacturing: Understanding Its Past and Its Potential Future- Martin Neil Baily and Barry P. Bosworth

To sum up, I have this provoking insight from

Neil Pasricha’s book Happiness Equation,

“Ninety-seven percent of lung cancer patients are smokers and ninety-seven percent of smokers never get lung cancer.”

So does this data point give smokers the excuse as 3% of the smokers get lung cancer? No the question to ask is what are the other life threatening diseases smoking causes?

You can manipulate and twist statistics to your advantage, hence it warrants that you view the issue holistically and not get swayed easily with statistics just as we do with miniskirts.

-

Previous Post

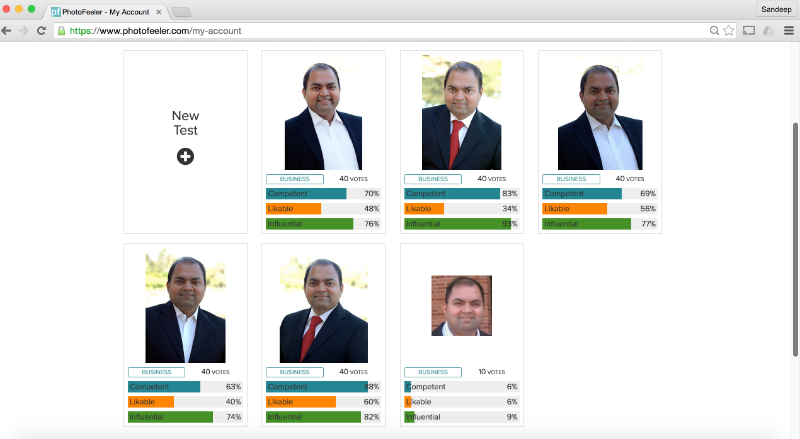

Linkedin Profile Photo Really Matters!!!

“oppna binance-konto

December 6, 2024Your article helped me a lot, is there any more related content? Thanks!

binance Register

December 20, 2024Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/es/register?ref=T7KCZASX

binance signup bonus

December 27, 2024Your article helped me a lot, is there any more related content? Thanks!

free binance account

February 5, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Bonus Pendaftaran di Binance

February 6, 2025Your article helped me a lot, is there any more related content? Thanks!

gratis binance-konto

March 11, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

binance account

March 20, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Λογαριασμ Binance

March 26, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

binance Empfehlungscode

April 6, 2025Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

bono de registro en Binance

April 14, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Daftar

April 28, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

cuenta abierta en Binance

May 3, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Anonymous

May 16, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Binance推荐码

June 6, 2025Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

创建Binance账户

June 8, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

criac~ao de conta na binance

June 26, 2025Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

pieregistrēties binance

June 30, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tài khon binance min phí

July 3, 2025Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Buka Akun Binance

July 3, 2025Your article helped me a lot, is there any more related content? Thanks!

binance registrering

July 22, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

bei binance anmelden

July 22, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

100 USDT almak icin kaydolun.

August 3, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

registrace na binance

August 5, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Gate.io

August 8, 2025The official platform of Gate.io offers secure and efficient digital asset trading services.

Skapa ett gratis konto

August 9, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

www.binance.com registrera dig

August 9, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

binance

August 10, 2025Your article helped me a lot, is there any more related content? Thanks!

binance

August 10, 2025Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

binance h”anvisningskod

August 15, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Binance

August 22, 2025Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/hu/register?ref=FIHEGIZ8

binance

August 27, 2025Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/pl/register?ref=YY80CKRN

binance

September 5, 2025Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/ES_la/register?ref=T7KCZASX

registrēties binance

September 12, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. inscreva-se na binance

Creati un cont gratuit

October 9, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

binance us Регистрация

October 21, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

binance US registrieren

October 26, 2025Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

binance register

November 21, 2025Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Binance

December 16, 2025Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/pt-BR/register-person?ref=GJY4VW8W

binance prihlásení

December 16, 2025I don't think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/cs/register?ref=OMM3XK51

b”asta binance h”anvisningskod

December 22, 2025Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/kz/register?ref=K8NFKJBQ