My friend Deb is in her 70s, invested in Nvidia back in 2017 at stock price of $4 equivalent of today’s price of $135 after accounting the stock splits. She has held it ever since and never sold. We tease her that she should sell some stock and take an exotic vacation. She quips- one never knows when is the right time to sell?

I told her my gut feel is that Nvidia mania resembles Cisco in late 1990s when the Internet was nascent stages very similar to how Artificial Intelligence is at this stage. I promised her that I will do some research, analysis and then present my findings in an article.

So in this article, I explore the similarities and differences between these two technological giants during their respective periods of stock price hypergrowth, providing insights into the factors driving their growth, market trends and investor sentiment. I summarize the expert opinons from Morning Star, Forbes and Motley Fool and then give my own personal opinion.

Introduction

The rise of Nvidia’s stock in recent years has drawn significant attention from investors and market analysts alike, with many drawing parallels to the meteoric ascent of Cisco Systems during the late 1990s dot-com bubble.

Cisco in the Late 1990s

During the late 1990s, Cisco Systems emerged as a dominant player in the networking hardware industry, riding the wave of the Internet boom. The company’s stock price soared as investors eagerly anticipated the transformative potential of the Internet. Key factors contributing to Cisco’s surge included:

- Technological Leadership: Cisco was at the forefront of networking technology, providing critical infrastructure for the rapidly expanding internet.

- Acquisitions: Cisco aggressively acquired companies to expand its product offerings and market reach.

- Investor Sentiment: The overall euphoria surrounding internet companies led to inflated valuations and high investor demand for tech stocks.

At its peak, Cisco was one of the most valuable companies in the world, with a market capitalization exceeding $500 billion. However, the dot-com bubble burst in 2000, leading to a dramatic decline in Cisco’s stock price.

After the company went public in 1990, Cisco stock surged more than 1,000 times over the decade, striking a high of $80 in March 2000. But then it was hit hard by the collapse of the dot-com bubble, plunging to a low of $8 on October 2002. More than 20 years later, Cisco has yet to reach that March 2000.

Nvidia in the 2020s

Nvidia, a leading manufacturer of graphics processing units (GPUs), has experienced a similar surge in recent years, driven by several key factors:

- AI and Machine Learning: Nvidia’s Compute and Networking equipment are critical for artificial intelligence and machine learning applications, making the company a key player in these rapidly growing fields.

- Gaming and Data Centers: The demand for high-performance GPUs in gaming and data centers has also fueled Nvidia’s growth.

- Cryptocurrency: The rise of cryptocurrency mining, which relies heavily on GPUs, has further boosted Nvidia’s sales.

Nvidia’s market value has expanded even faster, growing from roughly $32 billion in 2017 to $3 trillion now. That’s a multiple of 100 times in just seven years. The main driver of this recent growth is the company’s data center business, because of the dazzling demand for computing power from hyper-scalers and AI workloads.

Expert Analyst Opinions

When I began my research, I discovered that prominent stock research firms & publications like Morningstar, Forbes and Motley Fool have extensively covered the comparison of Nvidia to Cisco

Morningstar’s Perspective

Morningstar’s analysis draws a nuanced comparison between Nvidia’s current position and Cisco’s peak during the late 1990s. Brian Colello, Morningstar’s director of technology, notes that Nvidia was a larger and more stable business before its growth surge, unlike Cisco, which was still a startup.

Colello emphasizes that while Nvidia’s GPUs are immediately utilized in AI models, Cisco’s revenue was partly based on speculative internet growth. Despite Nvidia’s high valuation, Colello sees its business fundamentals as strong, though he warns of the risks of overvaluation and market corrections, particularly if macroeconomic conditions worsen (Morning Star)

Forbes’s Perspective-

Dan Irvine, Forbes contributor, highlights how NVIDIA has become a major player in AI, similar to how Cisco and Sun Microsystems were pivotal in the early Internet era. Irvine describes four phases of technological adoption:

- Early Investment: Investors with a long-term vision invest in nascent technology.

- Technological Development: The technology progresses, attracting sophisticated investors despite significant volatility and challenges.

- Mass Recognition: Widespread public awareness leads to rapid adoption and substantial market cap growth for leading companies.

- Maturation and Competition: Technology becomes mainstream, and leading companies face competition and potential market corrections.

Irvine argues that AI is transitioning from Phase 3 to Phase 4, with NVIDIA experiencing substantial growth. He cautions investors about the potential for an AI crash, drawing a comparison to Cisco’s dramatic decline after the dot-com bubble burst. Despite AI’s promising future, investors should be mindful of market history and prepare for possible downturns. (Forbes)

Motley Fool’s Perspective

The Motley Fool’s analysis delves into several key differences between Nvidia today and Cisco in the late 1990s. The article argues that Nvidia’s current market position is more robust than Cisco’s was, due to several factors:

- Founder-CEO Leadership: Nvidia is led by its co-founder Jensen Huang, whose technical background in electrical engineering and semiconductor design gives him a significant advantage. In contrast, Cisco’s CEO during the mid-1990s, John Chambers, did not have a founding role or a highly technical background.

- Competitive Moat: Nvidia’s moat is considered higher than Cisco’s was, thanks to its dominance in the AI GPU market and its vast ecosystem of developers using its software tools. This complexity and market position provide Nvidia with a significant competitive edge.

- Growth Strategy: Nvidia has largely grown organically, with strategic acquisitions like Mellanox enhancing its capabilities. Cisco, on the other hand, relied heavily on acquisitions to fuel its growth in the 1990s, which posed integration challenges and diverted resources from innovation.

- Market Position and Product Complexity: Nvidia’s GPUs are crucial for AI and high-performance computing, giving it a strong market position. Cisco’s networking products were essential during the Internet boom, but their competitive advantage was less pronounced compared to Nvidia’s current dominance.

The Motley Fool concludes that while Nvidia is not immune to market corrections, the comparison to Cisco in the late 1990s is superficial. Nvidia’s stronger fundamentals and strategic positioning in the AI market differentiate it significantly from Cisco’s situation during the dot-com bubble. (Motley Fool)

My personal opinion

We all like analogies and love to make comparisons. We do that in Sports- who is GOAT (Greatest of All Time)?

In American Football- Joe Montana who dominated the 1980s with 5 Super Bowl wins, or Tom Brady who dominated 2000s with 7 Superbowl wins or now potential of Patrick Mahomes who has won 3 Super Bowl Wins and still is 28 years with lot of years ahead.

Each one of their accomplishments is astounding- the eras were different and their competition was different. All of them have great individual records to speak of

Similarly, it is difficult to compare the market conditions and eras for companies. In the late 90s when Cisco thrived, the Internet boom was one of its kind, the Information Technology revolution had not occurred in most of the developing world who had no access to personal computing. Email that is built on Internet backbone was not widely used and prospect using Internet for commercial transactions and new marketing and sales channel had huge potential.

Today, with Generative AI there is plethora of potential to improve productivity, creativity and we are still in the early stages, Nvidia is the formidable player with great market share and competitive moat.

Having said that, I just wanted to see the company performance of Cisco’s glory years between 1997 to 2001 when the stock had peaked and Nvidia current performance to see we can see any trend.

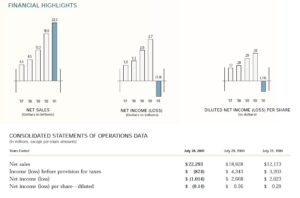

Cisco

Source – Cisco Annual report 2001

Cisco was annually growing at about 50% in revenues and 40% in net income from 1997 to 2001 until the global economy was hit in late 2000 when capital spending was dramatically reduced.

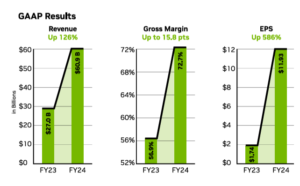

Nvidia

Source – Nvidia Annual Report 2024

Nvidia, on the other hand, has had phenomenal growth in the last year doubling its revenues, increasing profitability by 600% and most importantly gross margin improvements by 15% to high 70s which is unheard of in hardware industry. It explains the 5X growth of the stock price in the last one and half years.

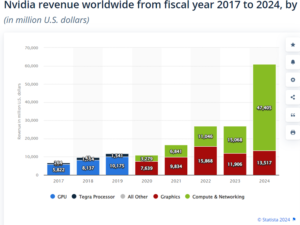

Source- Statista 2024

Nvidia has rightly timed its market transitions and built products meeting the unmet need. (Read my article on timing market transitions)

They have been building computing and networking equipment for AI for primarily hyper-scalers (Amazon, Microsoft, Google and Meta etc) who have been ramping up the capital spending in anticipation that there is going to be surge in demand from its enterprise customers for AI.

It needs to be seen whether this type of growth is sustainable over the next few years and there is no global economic downturn like how Cisco experienced in late 2000 where capital spending was first to be hit.

Here is a quote from the Cisco Annual Shareholders 2001 report

“In fact, in many ways, it was like two different years. The first period, from August through December, started out even more positively than we could have anticipated with year-over-year revenue growth over 60 percent, while the second half became extremely challenging. We obviously would have liked to avoid the challenges we faced in reduced capital spending and the global macroeconomic environment, which resulted in the reduction in our workforce and inventory charges we announced.”

It is very difficult to predict the top or bottom of any cycle but one thing, which has not changed is that Wall Street punishes companies for de-accelerating growth in revenue and profitability. Though there is substantial case that Nvidia is delivering stellar growth in terms of revenue and EPS, the overall market is also at all-time highs. So, it wouldn’t surprising for Nvidia to fall whenever the overall market falls.

My advice to my friend Deb is continue to rid the wave until there is accelerating growth in revenue and profitability- this may last for 6, 12 or 18 months depending on the overall market performance as nothing is etched in stone. I would certainly take a little- profits periodically from time to time while riding this wave.

As Futurist Roy Amara, says

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”.

The real true benefits of the Internet have been realized over the past decade and there was a lull in 2000s, similarly I am in Roy Amara camp and believe the true benefits of AI will be harnessed in 2030s and later on.

If you like this article, please feel free to read our article on GenAI- True Adoption in Enterprise Today

References

- https://www.morningstar.com/stocks/nvidia-2023-vs-cisco-1999-will-history-repeat

- https://www.fool.com/investing/2024/04/07/nvda-stock-ai-stocks-ai-bubble-cisco-dot-com-crash/

- https://www.forbes.com/sites/danirvine/2024/06/25/nvidias-explosive-growth-mirrors-tech-giants-of-the-past/

- https://www.thewealthadvisor.com/article/nvidia-oddly-similar-cisco-late-1990s