First, I am not a financial advisor. I am just passionate investor who wants to secure his family’s future during these times of uncertainty. I am writing this post to educate my network and do not treat it as financial advice. Please consult your own financial advisor.

Have you seen those Digital Ads or Click Baits – If you invested $1,000 in X company in year 1997, you would have made a 100,000% return as of today. One needs to note, there are very few people who just buy a company stock and hold a company stock for over 20 years.

It is like to win a $1Million Dollar lottery, you need to first buy a lottery ticket instead of just thinking or dreaming about it.

Well there are people like my aunt Rukmini who have just bought dividend yielding stocks in 1980s and never sold them till date. It has helped her during her retirement in a country like India where there are no social security benefits.

I have seen my dad do the same but unfortunately those genes never got activated in me until recently. Last year I missed the investing opportunity in Zoom Communications (ZM) after doing robust analysis, I did not trigger the buy button.

In August 2020, I invested in Celsius Network (CEL) crypto token.

As they say, there are always screaming buy opportunities at any given point of time. It is belief and conviction that one needs earlier on to press that buy button and just hold.

In this article, I will be covering about Zoom and presenting my analysis on why Celsius Network could be the next Zoom type or even bigger investment.

What made Zoom Successful?

During the Covid-19 pandemic this year, Zoom became a household name globally. Zoom has become a verb just like Xerox in 1980s.

How did Zoom take off in a crowded Collaboration space where there were dominant Big Tech players such as Microsoft Teams & Skype, Cisco Webex and Google Hangouts. Zoom did not have the brand recognition of these big companies.

In sports, an underdog may upset a favored team in 1-2 games but takes a lot for an underdog to become a formidable opponent.

In the Corporate world, Davids are the disruptors, who create a niche offering for an unmet need or create tremendous value in an existing product category.

Goliaths are the incumbent leaders, who have an established position with large market share in terms of revenue and profit, vast financial cash reserves and brand recognition in a given industry.

In my article, How does David take on and become Goliath? Startups disrupting industry leaders, I explain the life cycle stages of what it takes for a David to become a Goliath.

The primary reasons why Zoom became a success-

Experienced CEO- Eric Yuan

Eric Yuan started Zoom Communications in 2011 after leaving Cisco where he was the VP of Webex engineering team. Eric joined the Webex in 1997 as one of the founding engineers and grew within Webex, which got acquired in 2007 by Cisco.

Though Webex was the first cloud-based Software as a Service (SaaS) company, it was difficult to change the late 1990s architecture and Cisco did not have the appetite to rearchitect and cannibalize its various collaboration offerings.

Eric decided to start a company in this space. Eric has 11 issued and 20 pending patents in the Collaboration space.

Customer Centricity and Delivering happiness to Customers

Eric focused on building the best product and best service that customers would love. They ensured that the engineers participated in the Sales process and interacted with first few customers so that they could understand their needs and help build more robust product.

Their primary core value was to deliver happiness and get continuous feedback from the customers to improve their products.

They initially focused on the Small Medium Business (SMB) market segment with a Freemium Business Model (Free vs Paid). They made sure that product works and then they targeted the enterprise segment.

For any startup to compete in the enterprise segment where there are Goliaths like Cisco and Microsoft that have strong presence, you need to identify the pain points that Goliaths are not addressing.

Zoom identified enterprises had invested in expensive multiple proprietary video conference room hardware solutions that were incompatible with one another. The utilization rates were low 5%, they were not cloud friendly and sharing content was difficult.

The Zoom solution was cloud native software defined platform, wireless, easy to share content and available on any commodity hardware.

Achieving profitability and running lean operations

Eric had accumulated significant expertise in the video collaboration space over 14 years. He set out with 40 engineers and took 2.5 years to launch a software defined platform Zoom Rooms in Dec 2013. Zoom had 70% Offsite Development team in China and 30% Onsite team in US.

Zoom did not recruit their first Sales employee until 2014. They operated with a small Sales team and wanted to make sure that the product worked. They had their first marketing employee in 2015- nearly 4 years after inception and then build other support function teams such as HR, Finance when the company started growing in 2016-17. They also raised more money that was required so that he had cash in rainy day.

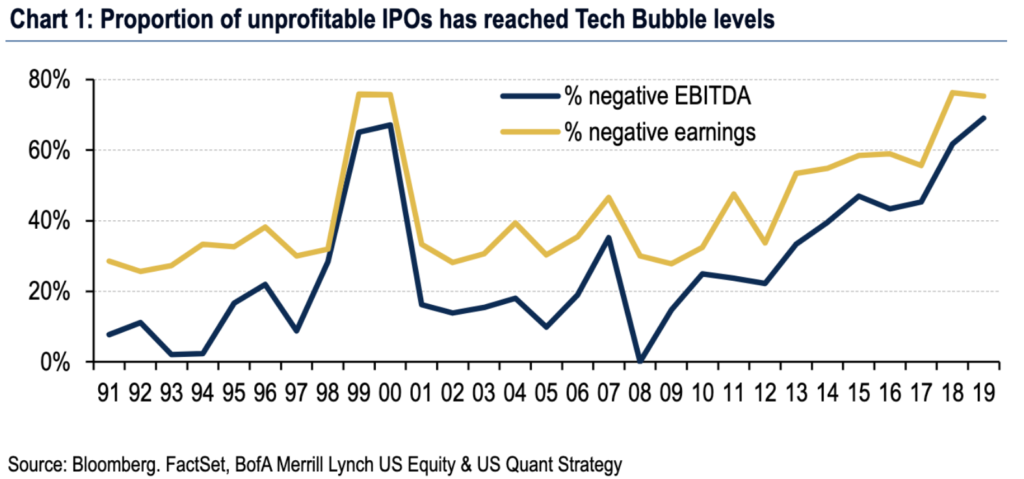

Zoom went public IPO in April 2019 as a profitable company, unlike 75% of companies that went public in 2019.

Black Swan Event and Market Opportunity

The Covid-19 pandemic provided a great market opportunity with global lockdowns and consumers and business needed to collaborate from their homes. Zoom was best positioned to scale as they had a good Freemium business model, experience with SMB helped target to consumers all over the globe.

Why Celsius Networks?

Alex Mashinsky, started his company Celsius Network in 2018 with the goal of offering the highest interest rates in the industry for individuals / corporate accounts who deposit their cryptocurrencies (Bitcoin, Ethereum, Stablecoins) in their lending platform.

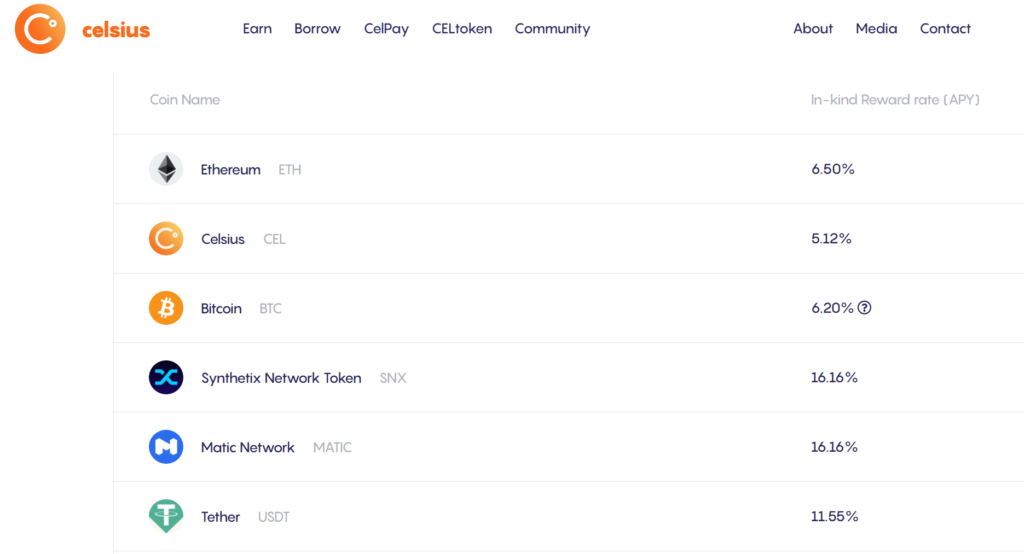

Source- https://celsius.network/rates/

The primary reasons for that make Celsius successful are

Experienced CEO- Alex Mashinsky

Alex Mashinsky is a serial entrepreneur who started 7 companies raising $1B in capital and exiting in $3billion. In the 1990s, Alex Mashinsky took on the phone companies as he believed that voice should be made free. Now he is on the mission taking on the banking industry.

He was one of the early inventors of Voice over Internet Protocol (VOIP)- the reason we are able to Zoom, Skype or Facetime. Alex has over 50 Patents and has the experience of being a CEO seven times

Alex holds weekly Friday call on Youtube – Ask Mashinsky Anything (AMA) where he takes Q&A and discusses about Celsius Network initiatives and the state of the industry. He is not reticent to acknowledge his mistakes along his entrepreneurial journey- such turning down Skype and Google when they were interested in his ventures.

Customer Centricity and Delivering happiness to Customers

Commercial banks currently hold our money and pay less 1% in interest. They keep 10% reserve and lend out 10 times the amount of money out to other institutions and individuals charging 4 % to 20% interest.

The banks keep 90 to 95% of the profit value paying out their shareholders in dividends or via stock buybacks. The customers earn just 5% value of profits in terms of less than 1% interest rates on their bank balances. This is a business model that favors the banks and not customer who is holding the deposits.

Celsius on the other hand has the company charter to return 80% of the profits to the depositors by providing higher interest rates than anybody in the industry. You can earn between 6 to 15% for different cryptocurrencies.

Alex identified the pain points that the hedge funds, cryptocurrency exchanges and other institutions do have access to capital from commercial banks to trade cryptocurrencies. Celsius offers them the ability to borrow any cryptocurrency at higher interest rates for a short period of time.

Celsius takes 150% of collateral from these institutions and asks for additional assets if the cryptocurrency collateral lose value so they don’t liquidate. Celsius does extra due diligence of the institutions before offering them loans understanding the intent for seeking the loan.

Unlike commercial banks that have fractional reserves keeping 10% reserve of the customer deposits and lend out 10 times the amount to the burrowers, Celsius keeps 10% reserve and lends out only 90% of money. This practice lowers the risk in case of a default.

Celsius also have filed with the SEC and various regulators around the world to ensure they abide by the government guidelines. This is not true of their competitors and the crypto space is still not fully regulated and there is risk for fraud.

Celsius has the philosophy to deliver happiness and look for the best interest of the customers. In order to incentivize the customer from not withdrawing all their crypto balances from the Celsius wallet, customers can also borrow short term loans at 1% on their deposits.

The commercial banks make billions of dollars of additional revenue charging minimum deposit fees, Checking account fees, overdraft fees and wire fees. Celsius has motto of not charging any hidden fees unlike traditional banks and its competitors. There is no minimum amount for deposits, no original fees, no withdrawal fees or termination fees.

BlockBuster, the video retailer, made a lot of money via late fees. Netflix disrupted their business model eliminating late fees. Recently the airline industry has eliminated the changes fees to incentivize the customers to fly.

You earn compounded interest and paid on a weekly basis unlike their competitors and they do not have 3-month lock in periods to earn higher interest. You can withdraw your funds at any time.

Achieving profitability and running lean operations

Celsius returns 80% of the profits to the customers by offering higher interest rates and keeps 20% of the profits for meeting expenses. Celsius is profitable and does not have a big marketing budget and advertises through word of mouth and referral programs.

They do not have celebrity/influencer endorsements like their competitors Blockfi, Nexo and Crypto.com.

Currently Celsius has 215,000+ global customers and Assets under management (AUM) is $2+ Billion in Cryptocurrency assets. The company has an objective to have 100 Million customers worldwide- almost 2% of world’s population. They have 600M in cash reserves and are well capitalized in case of any inadvertent event.

Celsius Network is very transparent and can see real time statistics such as Assets Under Management, number of customers and updated interest rates.

They have strategic partnerships with Line, BItfinex, Bitwala and many more.

The Celsius founders have the majority voting rights and recently raised $22M in equity funding round without offering any voting rights.

Celsius is not venture capital backed company and Alex wants to ensure that the company policy of returning 80% of the profits to the depositor is never changed.

Celsius is a mobile app available in IOS and Android. In order to become a customer, you need to provide Know your Customer details- driver’s license and photo ID. In order to access your app, you have 2 Step Factor ID Authentication.

There are many steps to withdraw and advanced security HODL mode if plan to leave your funds long term and make minimal withdrawals.

In the terms of security, Celsius has never had any hack or security breach. In case of any inadvertent event, Celsius guarantees that it will compensate the customer from its company treasury reserves.

It is refreshing to see companies having such charters especially when you see banking institutions involved in bailouts, precious metals manipulation, money laundering and fake account activities.

Black Swan Event and Market Opportunity

All the Central Banks are currently printing a lot of money and we are in the environment of negative interests. Customers are earning negligible interest and Fed interest rates are going to be zero until the economy recovers in 2023.

There is strong possibility that we might experience high inflation and central banks will not be able to increase the Fed Funds interest rate. In this situation, customers will see their savings debasing and losing value.

Only 1% of world has adopted cryptocurrencies and now with United States, China and Eurozone are planning to release their own Central Bank Digital Currencies (CBDC), we will see growth of the crypto lending space.

With the adoption and availability of cryptocurrencies such as Bitcoin in platforms such as Paypal and other exchanges we might see mass adoption.

Currently Celsius customers are individuals, there is tremendous potential for Small and Medium Business (SMB) to hold their working capital/ cash reserves in cryptocurrencies earning high interest. This would protect them against inflation.

You can only buy Celsius token from crypto exchanges and the Celsius equity stock is not yet publicly available.

CONCLUSION

To sum up, there are always screaming buy opportunities at any given point of time. It is belief and conviction that one needs earlier on to press that buy button and just hold.

Zoom and Celsius are both profitable companies and well capitalized, which is very important to for any investment. Due to low interest rates regime over the last few decades, companies that are not profitable at IPO are at all time high of 75%. It is indeed important to evaluate and balance sheets.

There are risks associated with any stock or cryptocurrency so it is necessary to do your own due diligence/ risk assessments.

Lastly, I am not a financial advisor. I am just passionate investor who wants to secure his family’s future during these times of uncertainty. I am writing this article to educate my network and do not treat it as financial advice. Please consult your own financial advisor.

REFERENCES

Startup Grind 2016 – CEO Eric Yuan Interview

Nasdaq interview– Alex Mashinsky

-

Previous Post

Why Invest Differently during Uncertainty?