First, I am not a financial advisor. I am just a passionate investor, who wants to secure his family’s future during these times of uncertainty. I am writing this post to educate my network and do not treat it as financial advice. Please consult your own financial advisor. These are my personal views and I do not represent Celsius Network.

Celsius Network, the cryptocurrency yield platform, has been in the news for the last few weeks as the company put on this statement on a Sunday night on June 12th 2022.

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.

Acting in the interest of our community is our top priority. In service of that commitment and to adhere to our risk management framework, we have activated a clause in our Terms of Use that will allow for this process to take place. Celsius has valuable assets and we are working diligently to meet our obligations.”

Read the Complete Memo and Community FAQ

As expected, the 500,000 + funded customers are worried about their money. There is Fear, Uncertainty and Doubt (FUD), with social media, prominent finance publications running articles of mergers, acquisitions and bankruptcies etc. As of June 30, Celsius mentioned that they pursuing strategic transactions as well as restructuring their liabilities.

In the meantime, Celsius Network’s competitor Blockfi announced a 20% layoff, signed a term sheet with FTX to provide a $250 Million Credit Facility, increased crypto deposit yield rates to incentivize depositors to stay on the platform.

On July 1st , FTX signed a deal with BlockFi that gives it the option to buy the lender at a maximum price of $240 million. The company increased the prior loan of $250 million to $400 million.

Another competitor Voyager, entered a definitive agreement with Alameda Research for a US$200 million cash and USDC revolver and a 15,000 BTC revolver and issued default notice Three Arrows Capital (“3AC”) for not paying the loan. They have suspended trading, deposits, withdrawals, and loyalty rewards on July 1.

So what is going on in the crypto yield industry space?

I have been challenging my assumptions, researching what is currently happening in the industry both as a Celsius Network customer (Celsian) and passionate ardent learner of new disruptive business models.

In this article, I present my analysis based on the publically gathered facts available to me. Among all the crypto lending companies, I continue to believe that Celsius Network may survive to come out stronger from this situation. Here are my four reasons.

- Diversified Business Model- different sources of revenue and achieving profitability by running leaning operations

- Regulatory Compliance and Transparency

- Credible Long term Equity Investors

- Strong Executive Management Team

Diversified Business Model- different sources of revenue and achieving profitability running lean operations

In the age of rampant inflation, with all the global fiat currencies rapidly debasing, and traditional banks providing below 1% or negative yields, Celsius Network was the first company, founded in 2018, with the mission to provide highest yield to the customers. It has paid over $1Billion dollars in yield till date.

The primary source of revenue is based on the traditional securities lending model.

Over the last two years, Celsius Network has diversified its source of revenue unlike other competitors: Coinbase, Blockfi and Voyager, who still primarily depend on traditional transaction fees, spreads or securities lending. This model is difficult to sustain during crypto bear markets.

Celisus seized the opportunity when China banned Bitcoin Mining in 2021 and has invested $500 million in Bitcoin mining operations – taking positions of $200M in Bitcoin Mining firms Core Scientific, Rhodium and Luxor Technologies.

Celsius has 22,000 Bitcoin application-specific integrated circuit (ASIC) miners, most of which are Bitmain’s AntMiner S19 series miners that are newer and more profitable than other mining equipment. Source (Barron’s May 2022)

Celsius acquired Israeli crypto custody technology firm GK8 for $115 million as most Bitcoin users are not technically savvy enough to hold their cryptocurrency private keys.

(Source- Ledger Insights )

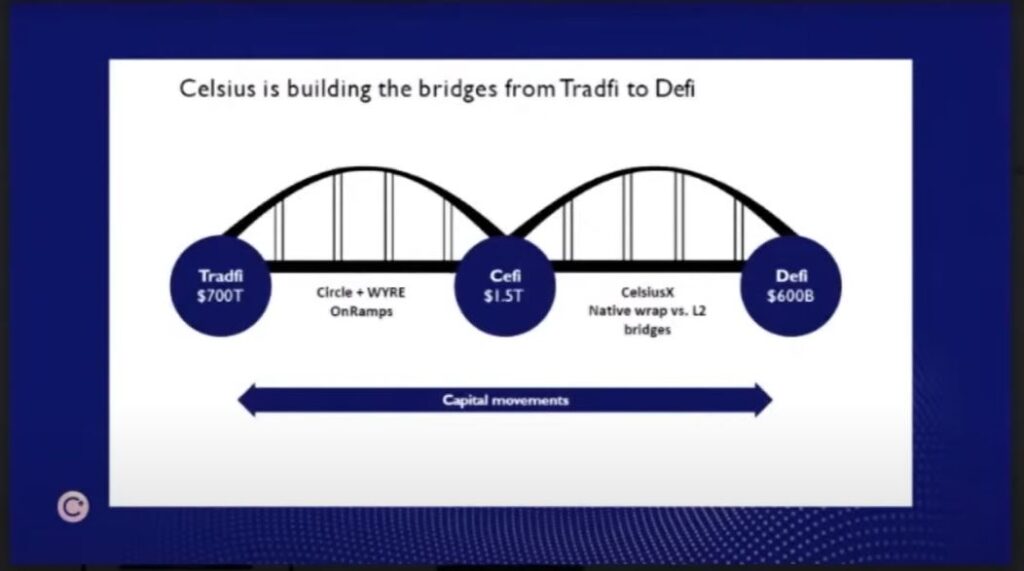

Celsius Network has been in the forefront building infrastructure connecting the traditional finance to Centralized finance (Cefi) to DeCentralized Finance. It also launched its Defi arm CelsiusX- cross-chain liquidity bridge connecting CeFi and DeFi by providing blockchain agnostic liquidity and interoperability.

(Source – AMA May 2022)

Celsius Network has been disrupting its competitor business models with launching features such as OnRamps and Swaps without charging high transaction fees.

Celsius does not have a big marketing budget and advertises through word of mouth referral programs and promotions. The viral strategy has helped them to reach 1.7 million customers globally from 100+ countries

It does not have celebrity/influencer endorsements like their competitors FTX who have Tom Brady & Gisele Bunchen, Voyager – Dallas Mavericks partnership and Rob Gronokowski or Crypto.com that has a sports stadium branded name in downtown LA.

Celsius has given paramount importance to security and never had any hack or security breach. They have 40+ global employees focusing exclusively on security. In case of any inadvertent event, Celsius guarantees that it will compensate the customer from its company treasury reserves.

They have around 800+ employees with employees located in the US, East Europe and Israel. They do not have plush offices in swanky Downtown locations and embrace hybrid work model.

The fact that Celsius Network was able to invest $200 Million in Bitcoin mining companies in June 2021 with seed rounds of 115M prior to the Series B $750 funding in Nov 2021 means it has been running a profitable business. (Source- CrunchBase)

Celsius Network has also recovered $50M in funds when users have sent cryptocurrencies to the wrong addresses and they have not charged any fees for recovery. This is the altruistic ethos of the company.

Ever since its inception, Celsius Network has been working with all the global regulatory institutions such as the SEC, FCA and other Euro regulatory institutions to abide by the government guidelines.

Celsius Network has been cooperating steadfastly with the US state regulators and abiding with local jurisdictions rules. They changed the policy of offering yield only to accredited investors in the US in April 2022 complying with the US regulators.

Regulatory Compliance and Transparency

This is not true of their competitors as the crypto space is still not fully regulated and there is risk for fraud. BlockFi settled $100 Million in penalties and registered Crypto Lending product with the SEC. (Source- SEC ).

Celsius Network has always been transparent and shared the sensitive business relevant information such as Total Assets Under Management, New User Growth, Asset Inflows and Outflows during the weekly AMA Calls for the last three years.

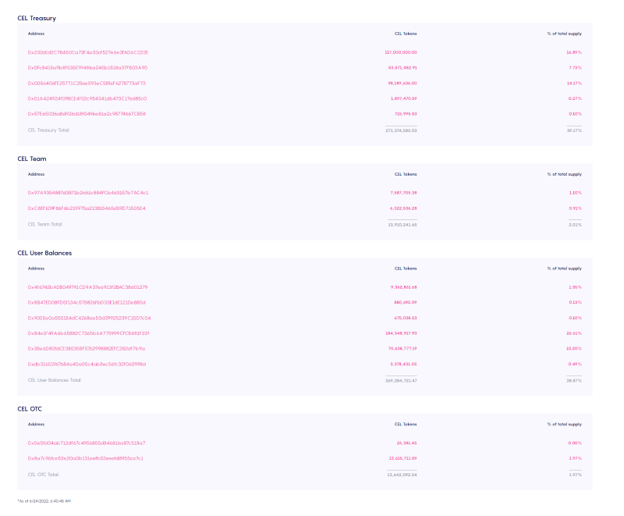

They have been transparent about the CEL token in the Treasury, Celsius team, User Wallets and OTC desk. ( Source- CEL Token Explained ). No other crypto company provides this level of transparency.

Source- Celsius Network- CEL token Explained

Credible Long term Equity Investors

Celsius Network is a privately held company and has received over $865M in funding. The major investors are the West Cap group and CPDQ.

WestCap is an early growth-oriented investment firm that specializes in the fields of e-commerce, mobile payments, and private markets. The firm invests in businesses across FinTech, RE Tech, Experience Tech, and Health Tech and partners closely with management to deliver distinct value.

CPDQ is a Canadian company that manages Québec public, private pension funds and insurance plans. It is a conservative investor and did nearly 6 months of due diligence before investing in its first crypto investment in Celsius Network.

No pension fund, especially a Canadian that leans more socialistic, will take a chance investing in a company if it does not see long term potential and less risk.

Experienced Management Team

The Celsius Network management has tremendous diverse professional experience.

Alex Mashinsky, CEO, is serial entrepreneur who has had 6 companies encompassing 3 $1B funded unicorns and $3 Billion in exits. He was a pioneer of Voice over IP and has more than 35 patents.

Rob Bolger, CFO, was the ex CFO of Royal Bank of Canada and held several executive positions in Bank of America

The rest of the executive team has entrepreneurial experience and worked for Fortune 500 companies with collectively 200+ years of experience running successful businesses.

Summary

To sum up, it is nerve wrecking for 500k+ Celsius Network global customers, who have their life savings invested in Celsius platform. They did in it trust because of the Celsius Network’s transparency as well to beat the inflation with dwindling interest rates offered by traditional banks.

We live in an era where FUD can be easily spread and one wants immediate updates. Celsius Network has always been communicative and for the past three weeks the company has only communicated whenever it has deemed necessary.

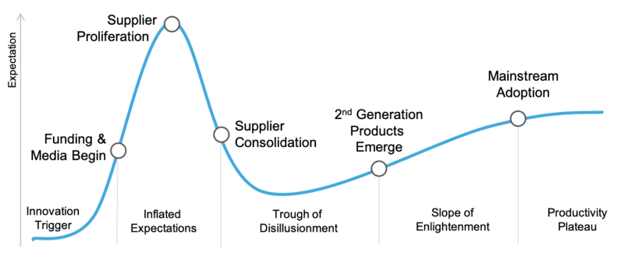

The Gartner Hype Cycle is a graphical illustration of a pattern that is commonly observed with new technologies or innovations. It portrays “the maturity and adoption of technologies and applications” as well as how they could provide solutions to real business problems and help make the most of emerging opportunities. (Source – ProductFolio)

The Crypto Yield Industry is currently in the ‘Trough of the Disillusionment’ phase in terms of the Gartner Hype Cycle as illustrated below.

We are already witnessing mergers and acquisitions in the crypto yield industry. Companies will definitely change and recalibrate their offerings: time based incentives for Hodling to avoid major bank runs, financial education for crypto loans and risk management- over collateralization.

This is also evident during the Dotcom bubble era when the many companies failed and companies that survived such as Amazon- adapted to change and diversified the business model.

According to Alex Mashinsky in his AMAs, since its inception in 2018, Celsius Network has survived 5 stress tests during bear market cycles including the 50% drop of Bitcoin on 12 March 2020. The company has always laid emphasis on risk management.

This June 2022 test is the ultimate and extraordinary. Hopefully Celsius Network may be able to do the same- survive and come out stronger.

These are my personal views and I do not represent Celsius Network.