NOTE-

First, I am not a financial advisor. I am just passionate investor who wants to secure his family’s future during these times of uncertainty. I am writing this post to educate my network and do not treat it as financial advice. Please consult your own financial advisor.

I have written a detailed 5000+ word blog and spent over 100 hours researching the topic. I recommend reading in a couple of sessions.

If you find this blog informative, please like, share or comment. If you love this blog, please donate money for a good cause raising funds for the Down Syndrome Connection.

https://www.ds-stride.org/bayareastepup/profiles/team/TeamNavya

Summary

The year 2020 has disrupted the world and we are going to witness paradigm shifts this coming decade. How do we prepare for them?

The current economic climate, political uncertainty, probability of social unrest due to rising income inequality, geopolitical landscape, US-China trade wars and deglobalization have led me to believe one should rethink their traditional portfolio allocations of cash, equities, real estate and bonds.

I discuss the Pro investment strategies of Warren Buffet, Value Investor, Ray Dalio, Hedge fund manager and Michael Saylor, CEO of Microstrategy.

I am proposing in addition to traditional assets to examine investing in BitCoin, Precious Metals and Blockchain projects. I will be discussing the value proposition and risks for each of these assets.

Current Economic Climate

I certainly have been bamboozled seeing the US equity markets and have been trying to make sense of what is going in the economy.

The economic pundits have yet to agree whether we are in Inflation, Deflation, Disinflation, Stagflation or going to be in Hyperinflation. Don’t ask me to explain these terms.

I see the US Federal Reserve (FED), Euro Zone and countries in Asia printing money in trillions of dollars, which they have been doing the last 10 years, to get out of this crisis. Unfortunately, we have deal with the consequences soon rather than later.

Due to the zero interest rates, investors have moved money from bonds to equities especially the top 10 Nasdaq 100 companies such a Big Tech firms and Tesla. Though these companies have benefited from the short term due to lockdowns, their current valuations are not justified with future growth & profitability and will correct sooner rather than later.

If interested, you can read my blog about Big Tech or eminent economist David Rosenberg’s post of 5 Signs that show this Stock market is a bubble.

There is temporary real estate asset inflation in some suburban housing markets as people are moving from the cities due to the lockdowns. The commercial real estate, airline, travel, leisure and hospitality have been badly hit and ironically, they were 80% of the jobs created between 2010 to 2020. Many of these jobs are not coming back.

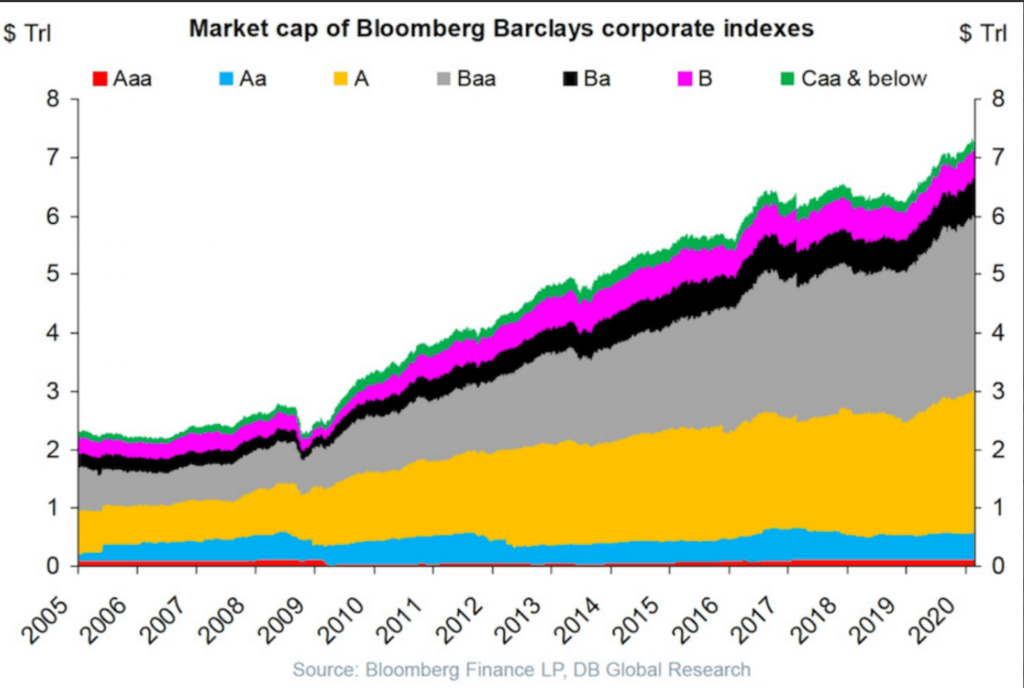

Due to low interest rates from 2010 to 2020, corporate debt has grown from $2 to 8 Trillion. Most of these companies have used the capital to do stock buybacks and dividends instead of investing in the business.

Currently the FED is buying these bonds but eventually print money to fund individuals and infrastructure initiatives. This is going have ramifications when in 2021-2023 when these debts are due to mature and they are unable to refinance because of economic conditions.

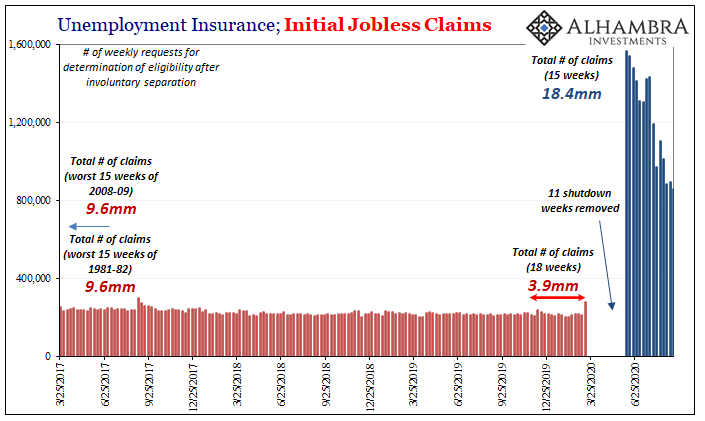

We can expect an economic Tsunami in 2021 as the number of first time jobless claims after the shutdown is 18.3 million in 15 weeks compared to 9.6 million claims in worst 15 weeks of 2008-09 or 1981-82 recession.

Jeff Snider- https://alhambrapartners.com/

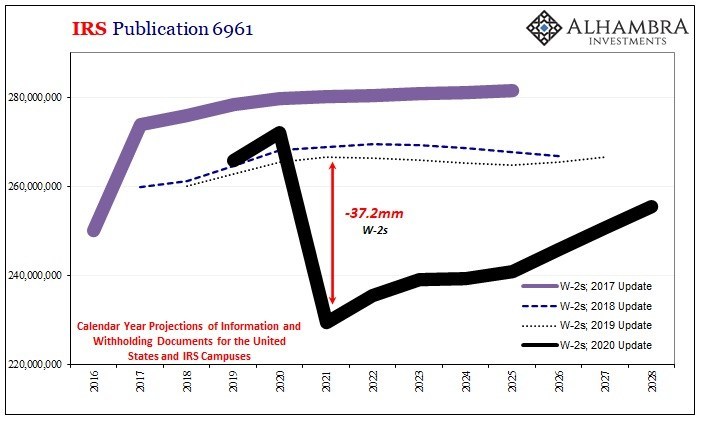

Jeff Snider, Head of Global Research, Alhambra Investments has analyzed the IRS 6961 Publication -W2 Projections over the last 4 years. Based on 2020 update, the Internal Revenue Service anticipates receiving 37 million fewer W2s in 2021 and does not anticipate to recover by 2028.

Source- Jeff Snider- https://alhambrapartners.com/2020/08/21/these-are-the-real-huge-jobs-numbers/

It doesn’t mean 37 million jobs will be lost but there will be lesser gig work W2 and employees changing jobs because of economic uncertainty.

Political Uncertainty

The upcoming 2020 election is going to be very close and it is important that whichever party that wins the Presidency, needs to also win the Senate and the Congress. Currently there is so much polarization and deadlock, it will not get any better when the country is facing tougher issues in 2021.

Social Unrest due to rising income inequality

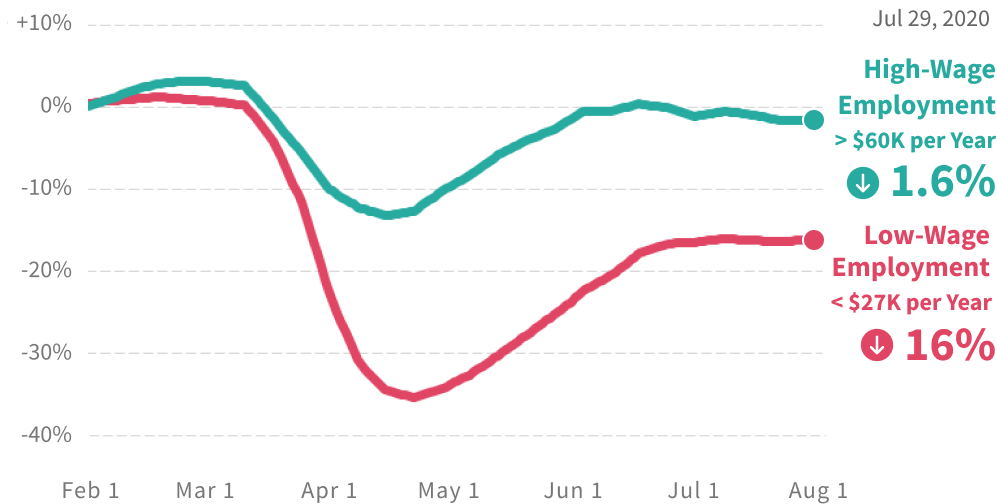

The Covid 19 lockdowns has increased the inequality gap. Like inflation, we have heard about U, V, L and now is K shaped recovery. You can never know; we might cover all the letters in English Alphabets assessing this downturn.

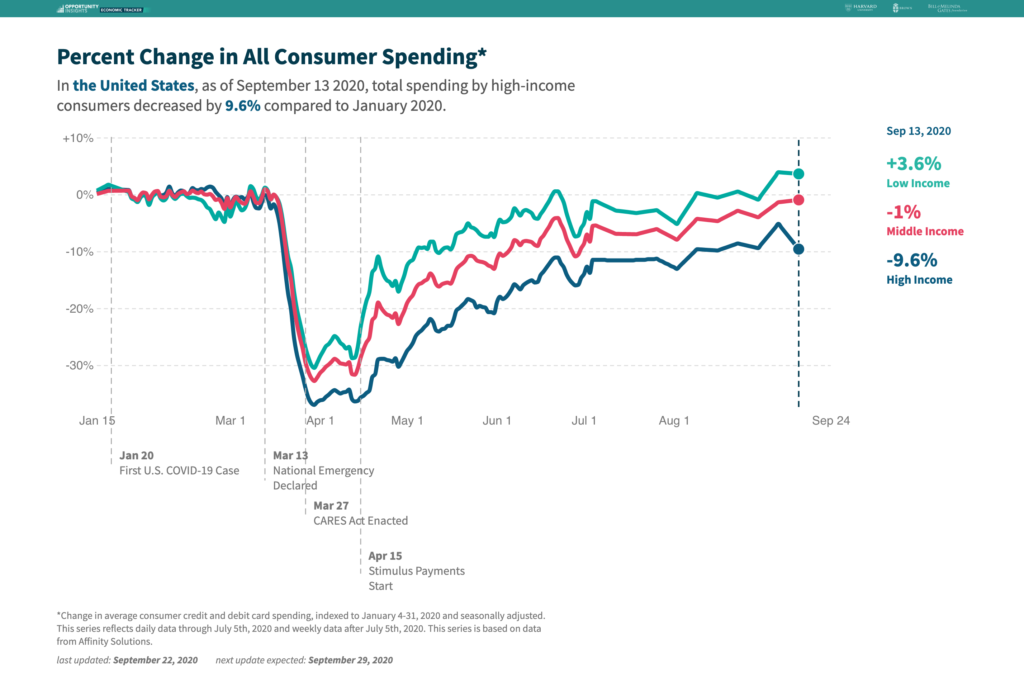

Raj Chetty. who runs the Opportunity Insights in Harvard University has developed a tool to track the economy recovery. As of July end, the Recession has nearly ended for high-wage workers, but job losses persist for low-wage Workers. This may change in 2021 when we see cascading effects.

Another interesting datapoint when you break consumer spending down by socioeconomic class, low income citizens are spending more today than they were in January and high-income citizens are spending almost 10% less. This is because of the government stimulus but that is drying up as lack of new stimulus as there is political deadlock in Congress.

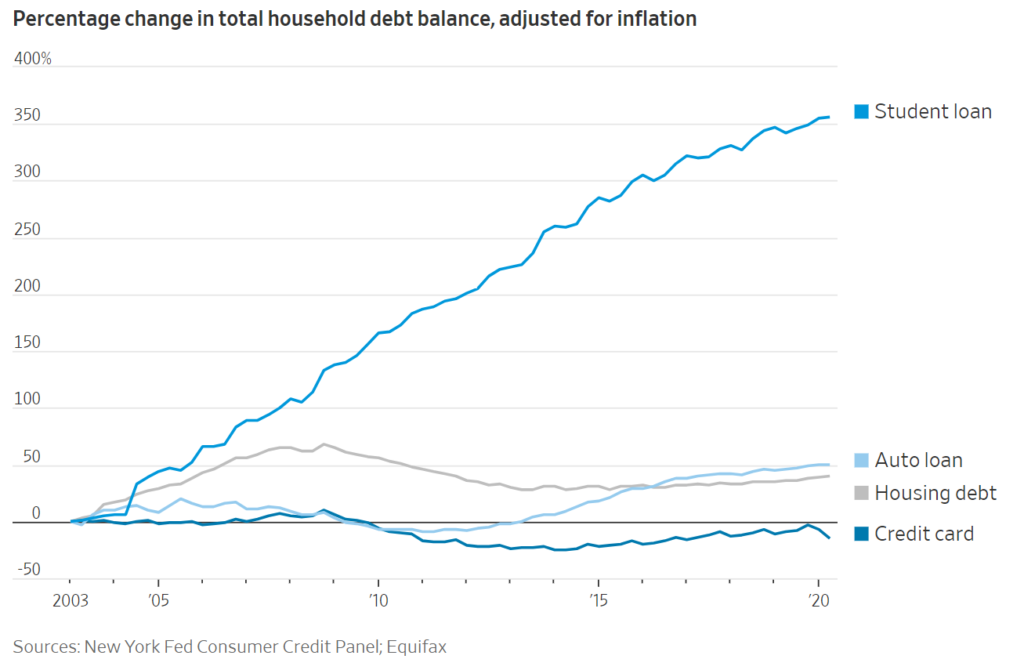

The Covid-19 crisis has disrupting the white-collar middle class especially the millennials with College degrees who have been seeing escalating inflation in college education over the last 20 years. These would be people who are born in early 1990s who took on student debt during the 2008 financial crisis as the interest rates were low. The chart below shows the 350% in student loan debt.

We will see college enrollments impacted as the younger generations will rethink if the college degree is worth it. The banks had eased auto lending so that people could get to work and we had seen increase in number of gig workers from 2015 buying new cars to make money via Uber and Lyft.

Many of these workers have unable to make their auto payments because people not traveling and have to return their cars.

There was tightening in the mortgage- lending standards between 2008 and 2015 but that eased with improving economy. The reduction in credit card debt is misleading because many people have transferred the credit card debt opening home equity lines of credit.

Many of the credit card and mortgage companies have given forbearance protection for 6 months to those who were unable to make payments due to job losses. Many of these people will be unable to pay them. This will have cascading effect on the banks and finally we may see government bailout the banks in 2021-22, which means more money printing.

We have seen social unrest because of the racial inequality and there is possibility that we might witness in 2021 is because of economic inequality.

Geopolitical Landscape and US-China Trade Wars

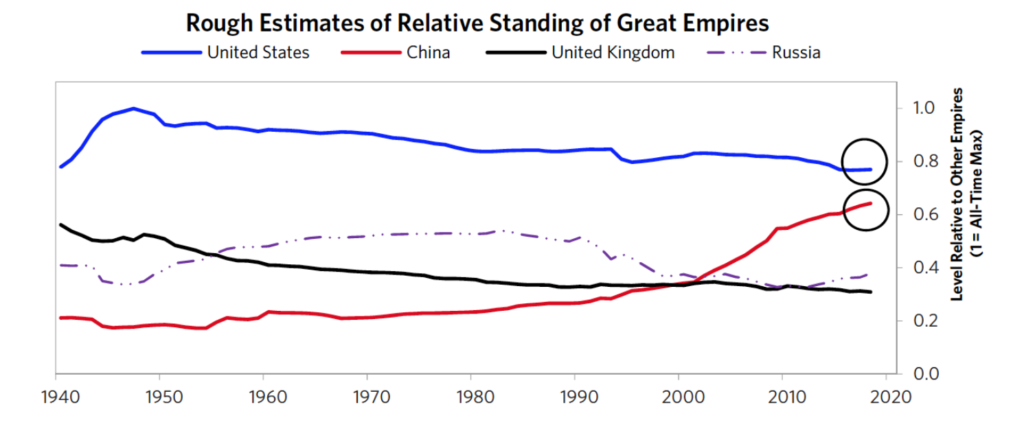

Ray Dalio, CEO- Bridgewater Associates, the largest Hedge fund manager, has been gracious enough to share chapters of his new book “The Changing World Order’ every few months on Linkedin. He has studied the history of the world over the last 500 years- the rise and fall of empires.

I will be giving a synopsis of my learnings as it is very relevant to consider the alternative asset classes.

Source- https://www.principles.com/the-changing-world-order/#chapter2

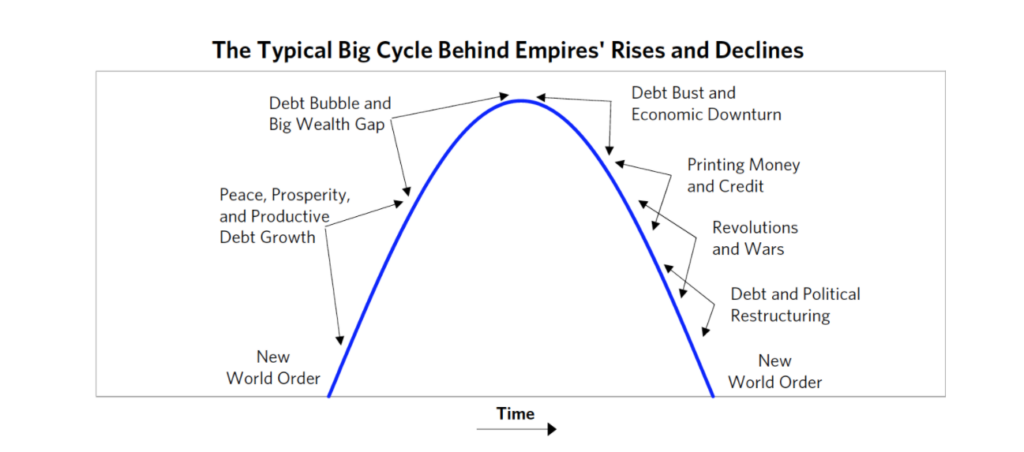

The above chart shows the various stages of Big Cycle. Countries grow making productive investments in infrastructure, grow human capital, creating wealth across the society and then there is debt bubble and increasing inequality.

The country hits the peak and then gradually declines with debt busts, money printing ending up in wars, devaluating and losing its reserve currency status, political restructuring and then resurrects in a new order.

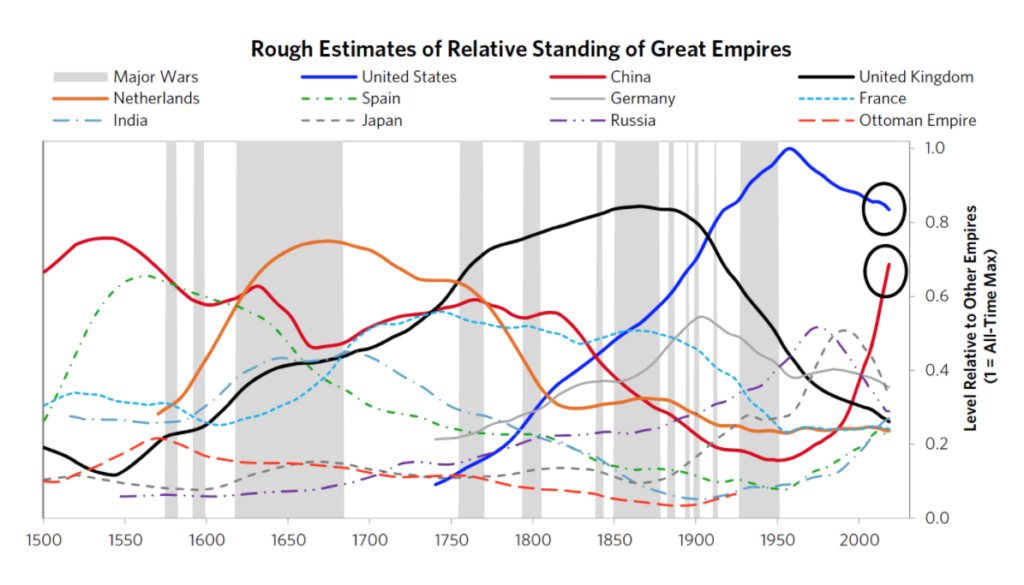

The chart below shows the rise and fall of all the big empires over the last 500 years. As you can see Dutch (red line) dominated 16th and 17th century. The Dutch Guilder was the reserve currency and lost out to the British in late 1700s. The British continued to dominate the world and English Pound Sterling was the reserve currency until the 1900s when the United States started rising.

Although the US had overtaken the UK militarily, economically, politically, and financially long before the end of World War II, it took more than 20 years after the war for the British pound to fully lose its status as an international reserve currency after a series of devaluations in 1949 and 1967.

Source- https://www.principles.com/the-changing-world-order/#chapter2

The Bretton Woods agreement in 1944 put the US dollar in the position of being the world’s leading reserve currency as US had around two-thirds of the world’s gold held by governments, which was the world’s money at the time. The central banks could exchange a paper dollar at price of $35 dollars per ounce for gold. It was nearly 100% gold backing.

Over the next two decades, US created dollar denominated debt to fund its economic growth, space and nuclear program, military expansion globally during the Cold War, Korean and Vietnam wars and was unable to allow holders of paper money to turn into gold at the price of $35.

In 1971, President Nixon decided to break away from Bretton Woods and devalue against gold. All the other countries adopted a fiat monetary system and started to create dollar denominated debt.

The US continued to create more dollar denominated debt through the oil embargo and oil shocks in 1970s resulting in inflation and gold as inflation hedged asset peaked to $670 per ounce.

China was a dominant power in 1500s and it was in decline until 1950s. The World War II created two ideologies- Capitalism and Communism. China had its internal war resulting with Communists winning under Mao Zedong.

China adopted the Marxist approach growing about 6% per year and low inflation at 2% though China continued to be poor until Mao’s death in 1976. There was power struggle resulting in the reformist Deng Xiaoping becoming the leader in 1978

Deng moved to a collective leadership model, opened China to the world- improving ties with the US and deteriorating relations with USSR. China started producing goods and services at low cost.

The US acquired US-dollar-denominated debt liabilities to the Chinese, and the Chinese acquired dollar-denominated assets owed to them by the Americans. This followed through 1997 when Deng died and continued through successors Jiang Zemin and Hu Jintao.

When Deng came to power in 1978, poverty was 90% and reduced to 40% at the time of his death. The poverty rate was 2% when Xi Jinping became the premier in 2013.

The political rhetoric in US started changing after 2008 Global Financial crisis. They realized that China was richer and powerful- becoming the manufacturing hub for entire world and at the expense of US job losses over the past three decades.

After Xi took over in 2013, he started focusing inward- accelerating reforms, managing and controlling the debt growth, flexibly managing its currency and supporting entrepreneurship.

They are also making market-oriented decision especially in industries that China wants to be a world leader and investing/cultivating trade relationships in Africa and Latin America.

Donald Trump came into power in 2016 with a populist agenda and has begun the US- China trade war negotiating trade deals with tariffs.

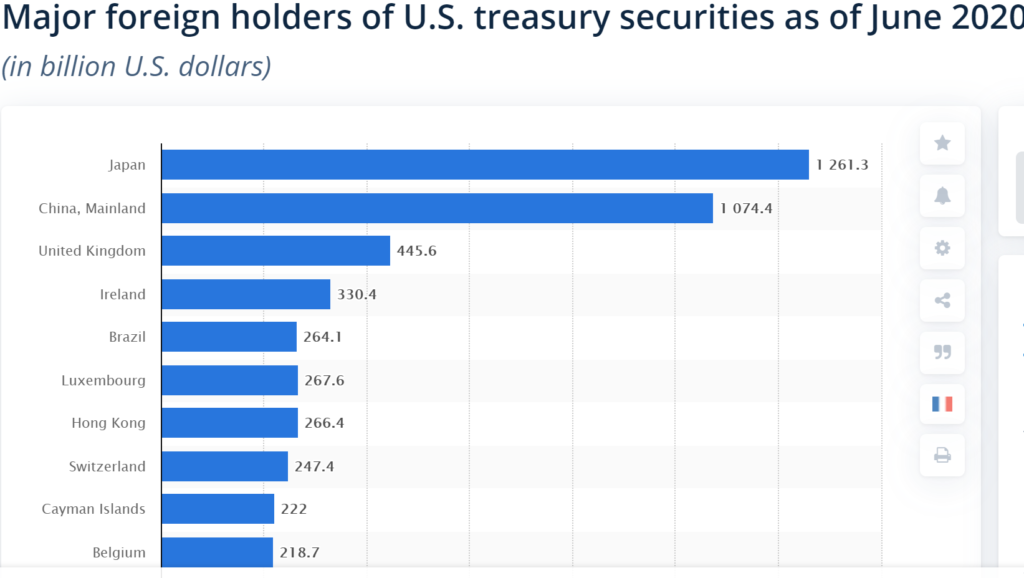

As of 2020, the above chart is Ray Dalio’s current standing estimate of the China, US, Russia and UK. China is the 2nd largest holder of US treasuries but the negative interest rates it may no longer look attractive.

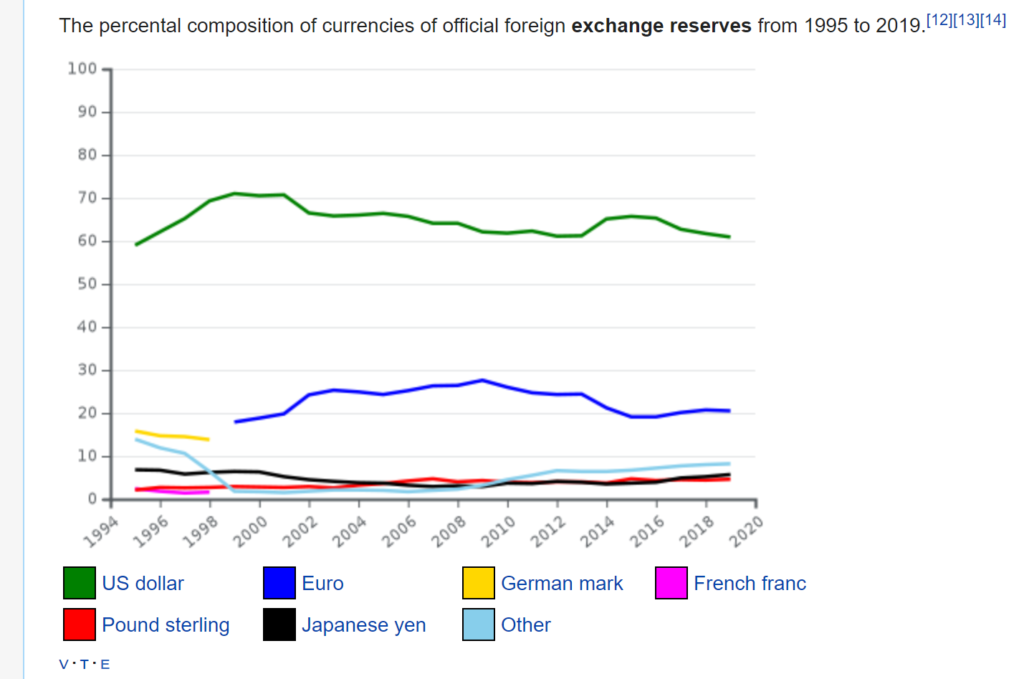

The US dollar continues to remain 60% of the world’s reserve currency followed by 20% in Euro and 2 to 3 % in Chinese Renminbi. Many countries still hold debt and make payments in USD and the oil and other commodities are priced in USD. The US has been so far able to print infinite amount of money, without worrying of Hyperinflation such as Venezuela or Zimbabwe.

Source- https://en.wikipedia.org/wiki/Reserve_currency

According to Ray Dalio, a country starts losing its reserve currency position when

- There is an already established loss of economic and political primacy to a rising rival that creates a vulnerability (e.g., the Dutch falling behind the UK or the UK falling behind the US)

- There are large and growing debts that are monetized by the central bank printing money and buying government debt, leading to

- A weakening of the currency in a self-reinforcing run from the currency that can’t be stopped because the fiscal and balance of payments deficits are too great for cutbacks to close.

The US and China are working Central Bank Digital Currency (CBDC) projects and it will be interesting to see the global adoption.

As Ray Dalio sees it, United States has gone through Big Cycles of successes, which led to excesses that led to weakening in a number of areas. China has seen its Big Cycle declines, which led to intolerably bad conditions that led to revolutionary changes and to the reinforcing upswings that it is now in.

China wanted to save a lot in the world’s reserve currency, which led it to lend so much to Americans who wanted to borrow so much, which has put the Chinese and Americans in this awkward big debtor-creditor relationship when these wars are going on between them.

Regarding the US-China relationship and wars, Ray Dalio believes that history has taught us there may be five types of war. 1) trade/economic wars, 2) technology wars, 3) geopolitical wars, 4) capital wars, and 5) military wars

I highly recommend reading Ray Dalio’s Book Chapters 6 for the rise of China and Chapter 7 for understanding the US-China relation and wars.

Deglobalization

SOURCE- PETERSONS INSTITUTE OF INTERNATIONAL ECONOMICS

After World War II, the world entered a period of Globalization growing steadily and reached its peak in 2008. Ever since the global financial crisis, it has been decelerating with growing Populism and the Covid-19 crisis is going to be another catalyst. We are going to witness a time period like the Interwar era (1914-1945)

China has also been focusing inward and the share of exports in terms of GDP has been decreased from 31% in 2008 to 17% in 2019. US is also embracing America First policy. We witnessed Brexit and interesting to see the dynamics within the European Union after Covid crisis.

US is retaliating against Chinese companies such as Tik Tok and Huawei just has China has been with companies such as Google. It will be interesting to see the dynamics after the US 2020 Election.

We have discussed the current economic climate, political uncertainty, probability of social unrest due to rising income inequality, geopolitical landscape, US-China trade wars and Deglobalization.

Now I will discuss the Pro investment strategies of Warren Buffet, Value Investor and Ray Dalio, Hedge fund manager, Michael Saylor, CEO of Microstrategy.

Investing Pro Strategies

Warren Buffet, the Oracle of Omaha, the most successful value investor of our times, has been sitting on $140B in cash, selling many of his US financial banks positions, investing $5.6B in 5 Japanese trading houses and made his first investment in Gold Mining company.

He has not added any new positions in Apple or Amazon, which have risen 50% in past 6 months at least until June 30th 2020 based on 13F Filings

Ray Dalio has 35% in US S&P Index betting on the asset inflations due to Quantitative Easing, 15% in Gold and 10% in Chinese companies and indices as of June 30th 2020 based on 13F Filings. He is bearish on bonds because of the negative interest rates and does not believe in Bitcoin as he considers it a volatile store of wealth.

In January 2020, before the pandemic took centerstage in the World Economic Forum, Ray Dalio famously said that ‘Cash is Trash’. It is even truer now.

Michael Saylor, founder and CEO, Microstrategy, business intelligence company, has invested $425M of the $500M company reserves in Bitcoin. His rationale is Bitcoin is a scarce finite asset of 21million bitcoins available in the world and unlike fiat currency that can be unlimitedly printed. Gold is a scarce asset but with technological invention it can still mined.

In an podcast with Saifedean Ammous, Michael explains that a million dollar government bond yielded $50,000 in 2010 but yields around $5,000 in 2020. So the inflation rate is 22% per year versus the CPI inflation of 2%. It is not worth holding a government bond as it erodes your purchasing power over time.

He is of the opinion that Bitcoin should be considered an asset -fiat vigilante and not traded as currency.

Michael is MIT graduate who is the longest serving Public company CEO for 22 years- he has seen his company stock go from $333 to 42 cents per share. He has survived all these years and managed to convince his Board and shared holders about having Bitcoin as reserve asset in Treasury.

Why Bitcoin?

If you asked me a couple of months ago- Do you know about Bitcoin? I would have said that it is based on Blockchain. It is very speculative- it went to $20k a couple of years ago and crashed. It is used by drug lords and mafia to transfer money? I really don’t understand and explain how it works?

Well I was not alone, 99% of the people in the world have that opinion and there is only 1% who understand blockchain and crypto currencies.

Like US politics, there is a lot of polarization regarding the value of Bitcoin.

It is a classic case of Confirmation bias where the Bitcoin critics and supporters have a tendency to search for and favor information that confirms their beliefs while simultaneously ignoring or devaluing information that contradicts their beliefs.

Bitcoin is decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Unlike gold or fiat currency, which is physical store of value, Bitcoin is a speculative digital virtual store of value. That is a difficult concept to understand and that is a reason there is no mass adoption yet.

Here is a 2 min video explaining Blockchain and Bitcoin. If you want to understand the origins of money- gold to fiat to Bitcoin here is a 12 min video. If you are a techie geek and want to understand how Blockchain works here is a 6 min video.

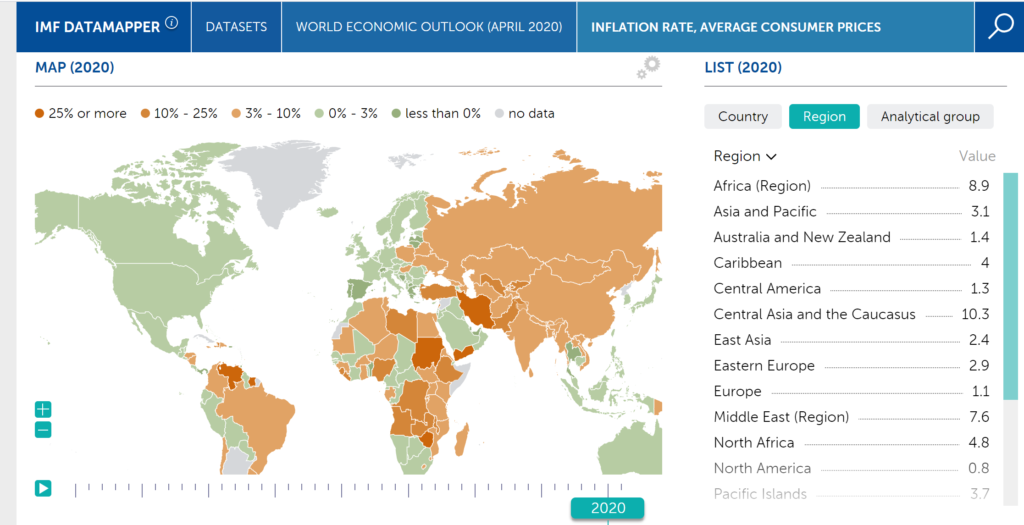

Most countries in the world are tied to fiat currency and have been printing money to meet their expenditure resulting the deficits and inflation. The chart below shows the IMF global chart of inflation.

SOURCE- IMF APR 2020 https://www.imf.org/external/datamapper/PCPIPCH@WEO/WEOWORLD/VEN

The countries marked in green are currently low inflation and color orange are between 3 to 10%. Countries marked in dark orange are Venezuela, Sudan, Yemen, Iran and Zimbabwe are in Hyperinflation 25% and above

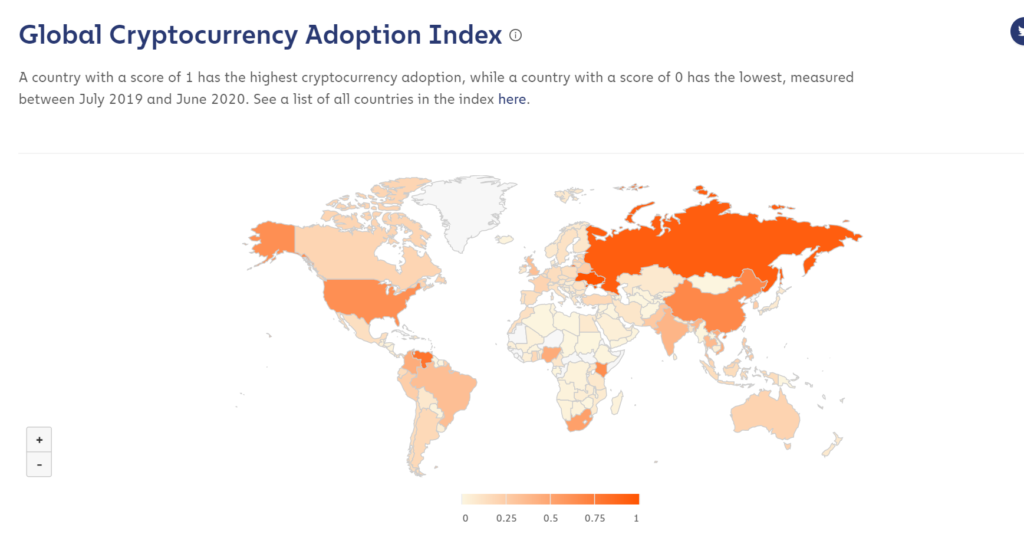

It is interesting to see that countries experiencing high inflation are adopting Crypto currencies.

SOURCE- Chainalysis USA https://markets.chainalysis.com/#geography

1.Ukraine 1

2.Russia 0.93

3.Venezuela 0.799

4.China 0.672

5.Kenya 0.645

6.USA 0.627

7.South Africa 0.52

8.Nigeria 0.459

9.Columbia 0.44

10.Vietnam 0.44

11.India 0.39

12. Thailand

14. UK

15. Pakistan

This is the report from US firm Chainalysis – countries with score 1 have highest adoption and 0 lowest.

Though these countries in the media say they don’t support crypto currencies like Bitcoin but they are different in reality. Countries like Venezuela that have 15000% inflation they are trying to freeze crypto accounts to protect their currencies.

Many countries in Africa such as Nigeria and Kenya are adopting Crypto currencies.

Here below is a great 2 minutes video of a phone trader in Nigeria paying his Chinese supplier in Bitcoin. Countries like Nigeria and oil revenue dependent countries do not have enough access to convert to dollars due to high inflation and government curbs. They use Bitcoin as a medium of exchange.

The video also depicts interview of the founder of Bitcoin Teller machine where you can insert your local currency and get converted to Bitcoin.

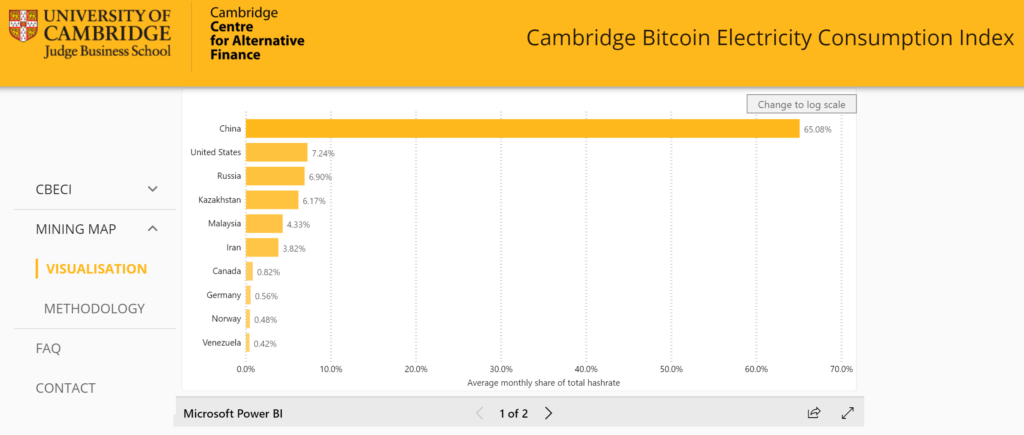

China (65%), US (7%) and Russia (6%) have been vocal against Bitcoin but they have been allowing their citizens to mine Bitcoin. It is interesting to see the dynamics in 2021.

SOURCE- University of Cambridge- Center for Alternative Finance https://www.cbeci.org/mining_map

Though Bitcoin had a lot of hype when went from $5000 to hit all time highs of $20,000 and then back to below $10000 it is getting attention of governments and investors. Japan is embracing cryptocurrencies and has many laws and regulating all the 23 exchanges.

Countries such as US and China are creating their CBDC currencies using the Centralized model. Governments do not want to embrace Bitcoin due to the decentralized nature as they have no control.

Bitcoin is considered Digital Gold and many supporters believe that it would become mainstream if one of the countries start accumulating Bitcoin and then announce that it is adopting Bitcoin as one of its reserve currencies.

The advocates of Bitcoin argue that it is scarce as there is going to be only 21million Bitcoins in circulation. No more can be mined hence it is going to follow the economics of demand and supply. Since fiat currencies can be unlimitedly printed and not pegged to gold it can be shortcoming.

Investors such as Paul Tudor Jones and Chamath Palihapitya recommend having 1 to 2% in your over portfolio as it offers an asymmetric bet. If 99% of your portfolio fails because of an event- the 1% can probably has the potential to 50 to 100X returns playing the role of hedge.

Bitcoin has been the best performing asset for the decade from 2010 to 2019 beating Tesla, Netflix, Domino’s Pizza or Apple. Here is a video depicting Bitcoin’s ROI of 60000% despite the crash.

Why Precious Metals- Gold and Silver?

Bitcoin is referred as People’s money and Gold and Silver is referred as God’s money.

Gold and Silver have been around for 5000 years and it always regarded a safe haven during times of crisis throughout centuries. Gold and Silver is always used as an inflationary hedge.

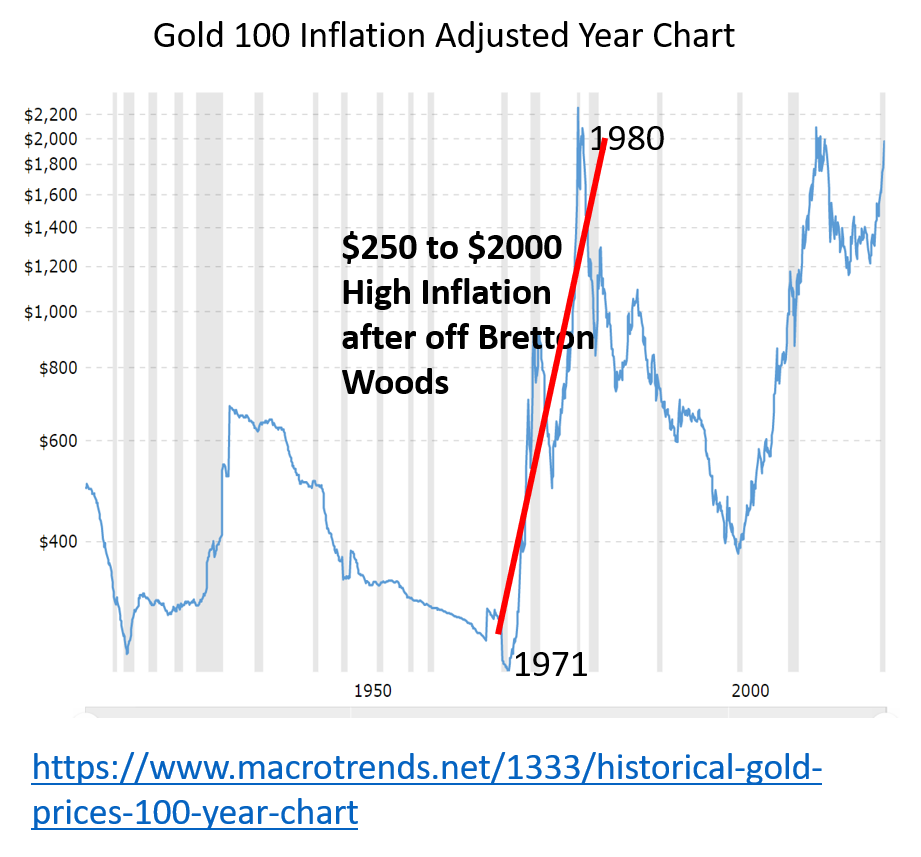

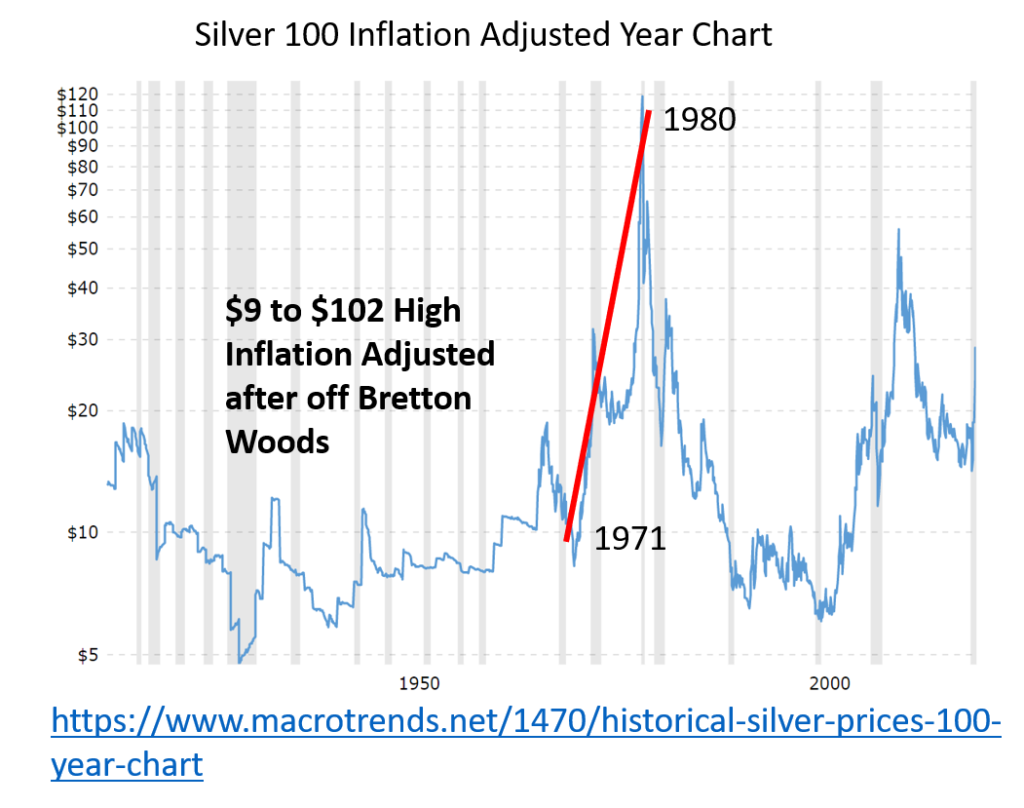

The last time US experienced high inflation was after it went off the Bretton Woods standard in Aug 1971. The inflation at that time was 4.6% and peaked to 14.8% in March 1980 and stabilized after 1982. That was the time when Paul Volcker courageously doubled the fed funds rate from 10% to 20% to fight inflation. It definitely helped stabilize the inflation.

Here are the 100 year Inflation Adjusted Charts for Gold

Inflation Adjusted Gold moved from $250 in Aug 1971 to almost $2000 in Oct 1980 before falling down for 20 years. In nominal terms it moved from $40 to $660.

Here are the 100 year Inflation Adjusted Charts for Silver

Inflation Adjusted Gold moved from $9 in Aug 1971 to almost $102 in Oct 1979 before falling down for 20 years. In nominal terms it moved from $ 1.30 to $30

Ever since the 2008 Global Financial Crisis, despite all the Quantitative Easing the inflation rate (CPI) has between average 1 to 2%. Over the last 6 months, after printing $3 trillion dollars, the inflation rate has been still remained between 0 to1%.

According to Department of Labor (BLS), Consumer Price Index-CPI (Inflation indicator) includes food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, andother goods and services.

The CPI also does not include investment items, such as stocks, bonds, real estate, and life insurance because these items relate to savings, and not to day-to-day consumption expenses.

As we all know that real estate asset prices, stocks, healthcare premiums, cost of education have all gone up and these do make a big difference in one’s cost of living. There is a lot of debate if the CPI is measuring the right basket of goods.

Economists differ if we are in inflation or deflation conditions right now but all of them agree we will have to end up in Inflationary environment.

So what does that mean for gold and silver. Since March 2020, Gold has moved from $1600 per ounce to $2000 and pulled back to $1870. Silver has moved from $14 to $28 and pulled back to $23.

We may see ups and downs until March 2021 when finally know election results and policy direction.

While we have considered the precious metals relationship with Inflation, Rick Rule, CEO of Sprott Holdings- Precious Metals Investments in an interview with George Gammon cites the following reasons for investing in Gold.

Gold has moved over centuries whenever people have the fear of degradation of the purchasing power of the savings in reserve currency- US treasury bond.

- Negative Real interests of Bonds- you get back less money than what you purchased for the bond. Purchasing Power is decreasing by 1.6% every year.

- Excessive Quantitative Easing and Federal Debt Liabilities of $26 trillion

- Currently Gold Ownership is lowest is below 0.5 % and the 30 year average ownership is 2%. The Gold ownership at highest in 1980 was 8%.

- Pension plans who have owned 10 years US Treasuries for last 35 years will not be making money and reallocate to Gold.

- Gold company stocks are attracting because the Operating Margins will be high as the management have instituted effective cost controls over the last 10 years since Gold has been in bear market.

- 35 Year Bond Market and 30 Year Stock Bull Market is coming to end. Financial advisors will have to look into new avenues.

Finally Warren Buffett and Ray Dalio may not believe in Bitcoin but they both are bullish on Gold.

Why BlockChain Lending Finance- Cefi or Defi?

Alex Mashinsky, the inventor of Voice over Internet Protocol (VOIP)- the reason we are able to Zoom, Skype or Facetime, is the pioneer behind the BlockChain Lending Finance. He is originated Money over Internet protocol (MOIP)- earning interest on crypto currencies in a lending platform and thus creation of Cefi and Defi.

Check out his Nasdaq interview speaking about his background, VOIP,

There are two types of BlockChain Finance (Source– Swiss Borg)

Centralized Finance- (CeFi) mimics the legacy financial industry by allowing people to earn interest or get loans, whereby they use their cryptocurrencies (Bitcoin, StableCoins Ethereum) as a form of collateral.

In a nutshell, corporations act as lenders and bear custody of their clients’ funds/assets while they put them to use to provide interest for the lenders. Example- Celsius, Nexo, Blockfi, Crypto.com

DeCentralized Finance- (DeFi)- DeFi refers to the application of smart contracts to financial instruments thereby removing the need for users to trust a middleman or corporation.

DeFi offers a slew of products such as flash loans, derivatives, permissionless trading and margin calls, insurance, etc. Example- MakerDao, Aave, Compound

With DeFi, users trust a protocol rather than a corporation or human, i.e. they trust codes to deliver on any human or entity’s behalf. The DeFi space is relatively new and risky. You can read more about CeFi vs DeFi in the Swiss Borg article.

I recommend Cefi lending as it less risker than Defi lending.

In the 1990s, Alex Mashinsky took on the phone companies as he believed that voice should be made free. Now he is on the mission taking on the banking industry.

His premise is that banks currently hold our money and pay less 1% in interest. They keep 10% reserve and lend out 10 times the amount of money out to other institutions and individuals charging 4 % to 20% interest.

The banks keep 95% of the profit value paying out their shareholders in dividends or via stock buybacks. The customers earn just 5% of profits.

Alex started his company Celsius Network in 2018 with goal of offering higher interest rates for individuals who deposit their cryptocurrencies in their lending platform.

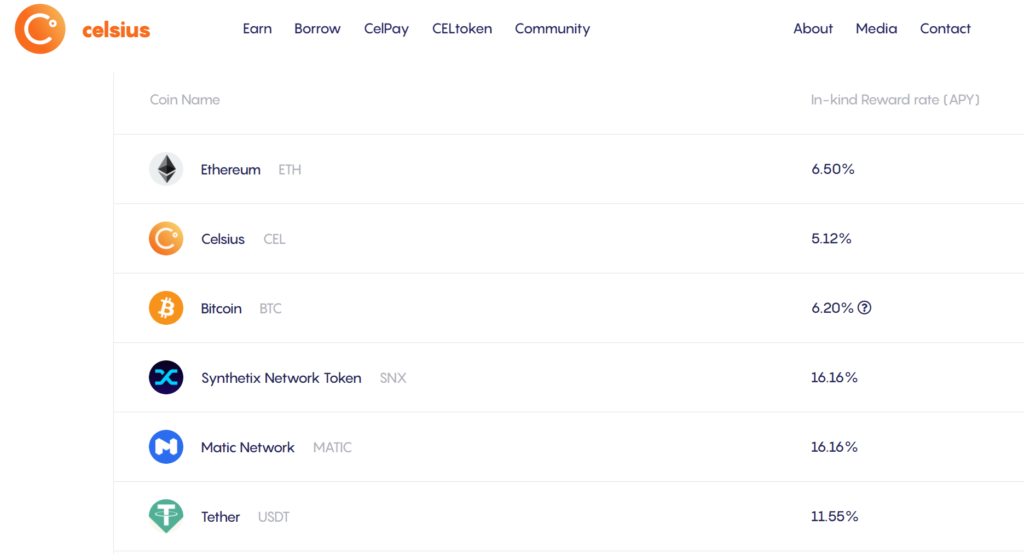

Source- https://celsius.network/rates/

Celsius lends these cryptocurrencies to hedge funds, cryptocurrency exchanges and other institutions keeping 10% reserve and lend out only 90% of money. They take 150% of collateral from the borrower and ask to the borrower additional assets if the cryptocurrency lose value so they don’t liquidate.

Celsius has the company charter to return 80% of the profits to the depositors by providing higher interest rates than anybody in the industry. They keep 20% of the value for meeting expenses and profitable. The company is operating leanly. Celsius does not have a big marketing budget and advertises through word of mouth and referral programs.

A low risk non speculative strategy is to earn interest via Stablecoins. Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some “stable” asset or basket of assets. A stablecoin can be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities.

For example you can convert $1 USD to convert 1 Tether USDT or Gemini GUSD backed earning up to 12%. You buy Paxos Gold cryptocurrency that is pegged to gold and earn up to 5% interest. These stablecoins can be converted back to fiat currency whenever you need it.

The Celsius founders have the majority voting rights and recently raised $22M in funding round offering stock voting rights.

Celsius is not venture capital backed company and wants to ensure that the company policy of returning 80% of the profits to the depositor is never changed.

The traditional banks make additional revenue charging minimum deposit fees, Checking account fees, overdraft fees and wire fees. Celsius has motto of not charging any hidden fees unlike traditional banks and its competitors. There is no minimum amount for deposits, no original fees, no withdrawal fees or termination fees.

Currently Celsius has 175,000 global customers and holds $ 1.2 Billion in Cryptocurrency assets. The company has an objective to have 100 Million customers worldwide- almost 2% of world’s population.

Celsius Accounts are not available in the countries of Iran, North Korea, Sudan, South Sudan, Syria, Cuba, or any other country against which the United States, the United Kingdom or the European Union imposes financial sanctions or embargoed.

Celsius Network is very transparent and can see real time statistics. Alex holds weekly Friday call on Youtube – Ask Mashinsky Anything (AMA) where he takes Q&A and discusses about Celsius Network initiatives and the state of the industry.

Fireblocks and PrimeTrust are the custodians that provide insurance on assets. Celsius generates interest rewards by lending out the assets to onboarded partners. When these assets are lent out, they are not insured.

All of the loans are collateralized up to 150%, meaning the borrower gives Celsius an alternative asset as collateral for the asset they are borrowing.

Celsius is available on Mobile application. In order to become a customer, you provide Know your Customer details- driver’s license and photo ID. In order to access your app, you have 2 Step Factor ID Authentication.

There are many steps to withdraw and advanced security HODL mode if plan to leave your funds long term and make minimal withdrawals.

In the terms of security, Celsius has never had any hack or security breach. In case of any inevitable event, Celsius guarantees that it will compensate the customer from its company treasury.

It is refreshing to see companies having such charters especially when you see banking institutions involved in bailouts, money laundering and fake account activities.

Full Disclosure- I am Celsius customer and providing all this information on my own accord. I researched the company before becoming a customer. Nexo, Blockfi, Crypto.com are the competitors and other exchanges offer interest rates. I personally prefer Celsius because of the founder’s philosophies and values. Alex Mashinsky is a serial entrepreneur involved in 7 companies raising $1B in capital and exiting in $3billion. He has the best CEO profile when compared that of the competitors.

CONCLUSION

To sum up, the data does not LIE and all the economic, social and political indictors are showing that the traditional portfolio allocations of cash, equities, real estate and bonds will not work in this downturn. I am an ardent student of history and believe in country lifecycles and business cycles.

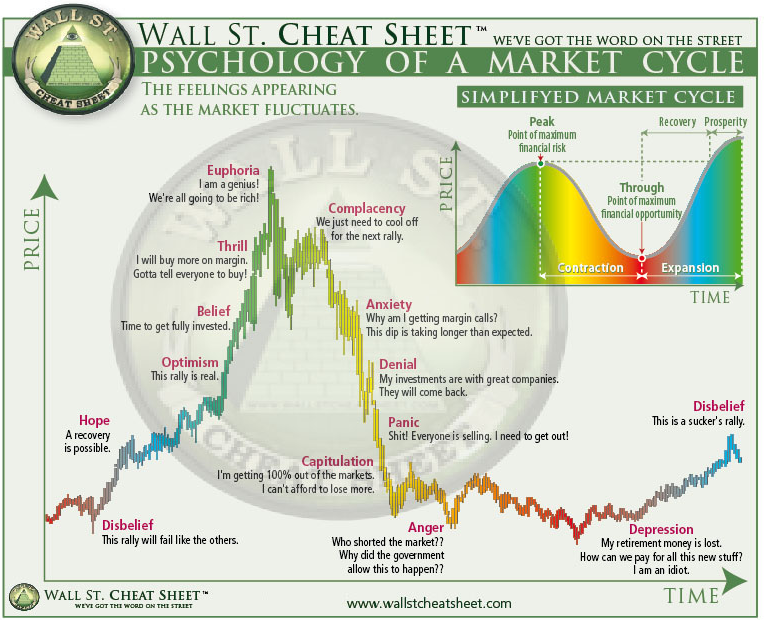

The chart below is the Wall Street Psychology of Market Cycle. I would like to leave you to ponder to putting every asset class such as Cash, Stocks, Bonds, Real Estate, Bitcoin, Precious Metals and Crypto Lending. You will get your answers.

While I complete writing this blog, I would like to take this moment to be grateful and fortunate to writing about Investing. There are people out there who are not able to make their expenses leave aside investing.

I don’t know what is in store for us in the coming years ahead. There is a likelihood that some of us may face career transitions. We just need to be prepared so that we manage our savings effectively.

If you have reached so far, Thank you for taking the time to read my blog.

If you find this blog informative, please like, share or comment. If you love this blog, please donate money for a good cause raising funds for the Down Syndrome Connection.

https://www.ds-stride.org/bayareastepup/profiles/team/TeamNavya